The handbook for a (stock market) crash

What you need to do now and what are the best buys right now

Intro

In times of turmoil, it is important to have a guiding light, or in other terms a handbook waiting for you to tell you what to do. You don’t want to be in a situation where you are trying to figure out what to do with your portfolio while the markets are crashing. There are many people who have sleepless nights and then panic-sell their holdings because they are afraid of the future.

It is worth repeating:

You can borrow ideas, but you cannot borrow conviction.

That is one of the reasons why I am publishing this Substack. It helps me to organize my thoughts and investment criteria, and it helps you to better understand the fundamentals of a company. Only if a company has strong and sound fundamentals will it weather the storm that eventually comes.

Those people who buy companies because “it felt good” or they heard someone talking about it are the very people who don’t know what to do when said holdings go down. If you are one of these guys who did their research, you can sit back, enjoy the show, and even better: Add to a wonderful company at a great price.

This quote from Napoleon summarizes in a beautiful way what we are trying to achieve with our portfolio

“A genius is the man who can do the average thing when everyone around him is losing their mind”

To make this more realistic, I asked ChatGPT to make a picture of Napoleon investing in stocks.

It seems like the poor guy grew a third arm. That was ChatGPT’s answer when asked about the third arm. Anyway, let’s move on.

On tariffs

Tariffs have, by and large, negative effects on the majority of the population in any given country. Consumers pay more for their goods, and due to the increased prices of goods, companies will face a harder time making money and in turn, might be forced to reduce their workforce. In the worst case, a person might lose their job and at the same time pay more for their everyday life. Some companies may profit from reduced competition from foreign companies,s but these instances are rare.

In case of the current tariffs, Nobody knows what will happen next. Literally nobody. Yesterday’s news is outdated at the speed of light, and with the stroke of a pen, tariffs might double or disappear.

Given today’s knowledge, let’s have a look at some of my larger holdings to better understand if a) they are impacted by the tariffs and b) if the investment thesis has changed.

In more detail

Starting with companies that are already struggling: European car makers. While I love driving great cars, I would never invest in European car makers. The only exception is Ferrari, but I see Ferrari more as a luxury brand than a car maker. The saying when it rains, it pours applies perfectly to Volkswagen et al. I touched upon the struggles of Volkswagen here.

Apart from the bad news coming out of China, the (for some car makers) second-largest market, namely the US, suddenly got a lot more complicated. Audi does not manufacture any cars in the US and until now relied on imports from Mexico and Germany. This is a major issue with the newly announced 25% tariffs on foreign cars. As a first action, Audi has suspended all imports into the US. Talk about the immediate impact of the tariffs…

Moving on to some great companies:

AMD

AMD is making good progress with its new GPUs, and I doubt the US government will harm one of its biggest success stories of the last decades. The export of high-end GPUs to China is already limited, and chips are the modern-day oil. Without it, nothing runs. AMD will be fine.

Learn more about AMD here

Alphabet

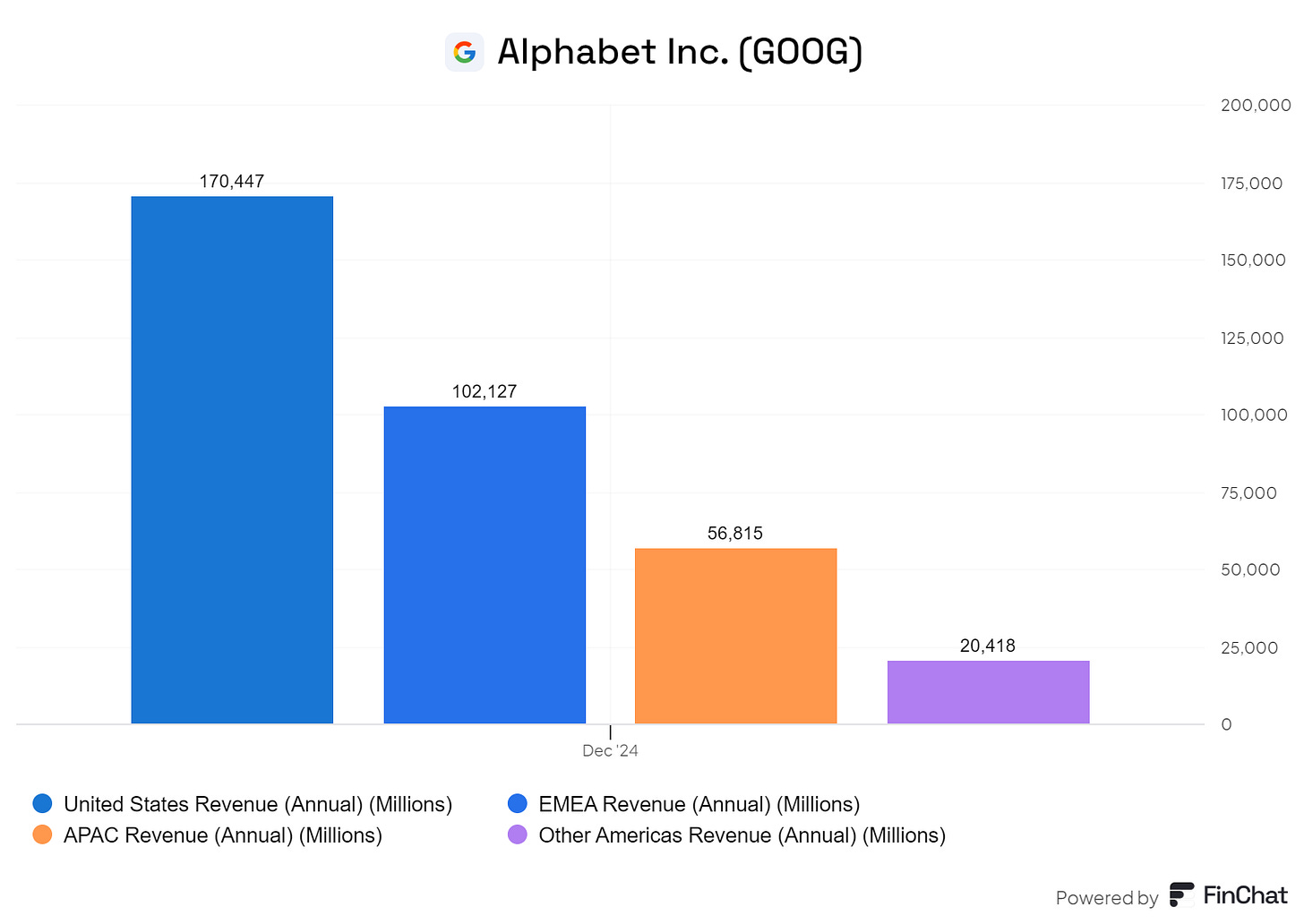

Since Alphabet barely ships physical goods, its products are not as impacted as for example, Nike shoes (which are made mostly in Vietnam). The European Union threatened a digital tax on American companies, which will surely impact Alphabet. Details and the implementation of such a tax are to be seen. Given Alphabet’s revenue share in EMEA, this would hurt the company.

One topics where Alphabet would face large pressure are the potential tariffs on chips. Alphabet’s planned $75 billion CapEx for Google Cloud and AI would be hit hard.

Considering the strong position of Alphabet and the monopoly-like standing it has in many end-customer products (think Search, Maps, YouTube), I believe Alphabet is one of the best companies to stay invested in. Learn more here

Salesforce

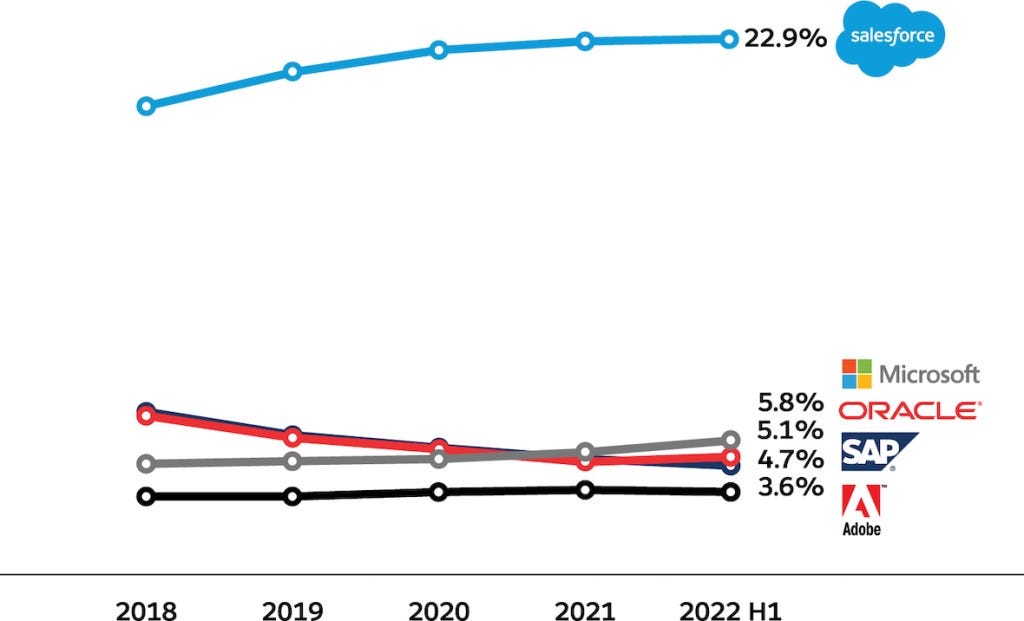

Salesforce is a fantastic company. Period. Salesforce is by far the market leader in CRM (customer relationship management software), which is crucial for any company.

This position and the large lock-in costs for their customers make it hard to switch providers. At the same time, Salesforce is rolling out its own AI agents, which benefit from the insane amount of data stored across its platform. A potential digital tax would hurt Salesforce, but its underlying fundamentals stay strong.

Meta

Similar to Alphabet, Meta enjoys a fantastic position amongst its users. I don’t know anyone who is a regular smartphone user who does NOT use any of Meta’s products. WhatsApp, Instagram, Facebook. The DAILY active users are above 3 billion.

If there were a severe recession as a result of the tariffs, Meta’s advertisement revenue would decline. Given its gross margins above 80% and the operating margin above 40%, Meta would be just fine.

Of course, a digital tax and increased costs for chips would hurt Meta.

Amazon

If you want to read the full article and learn about Amazon, ASML and which stocks are the best buys right now, please subscribe and support my work.

To all existing subscribers: Thank you for your support, and enjoy the rest of the article!

Keep reading with a 7-day free trial

Subscribe to 41investments’s Substack to keep reading this post and get 7 days of free access to the full post archives.