In this short format, I want to present to you companies and stocks, which are currently valued at an attractive level. Writing a deep dive takes me many hours and with this format, I can introduce you to interesting ideas as of today.

I will only recommend high-quality businesses and I am not interested in cheap, but mediocre companies. Always keep in mind, that the quality of the company is the first filter. If it does not possess a very good business model, I am not interested in the company, even if it is dirt cheap. With that being said, let’s start!

Both companies presented today are among the largest holdings in my portfolio and I have added to both in the last weeks.

If you say this looks familiar to the best buys of October, you are certainly right. Most companies that I keep track of are too expensive at the moment and only those two stand out.

Alphabet

Investing doesn’t have to be hard. I bet all of you know and have used Google for the last 15+ years. Compared to that, most people kept searching for the next star instead of just buying Alphabet. Consider me one of these investors, before I finally saw the light and bought Alphabet shares in 2018 as a long-term holding and not just as a trading position.

To google has become a synonym for searching for information online. Now add YouTube, Google Maps, etc and you will find many apps that you can’t imagine living without. That’s a great fundament for a company and therefore an interesting investment.

Where it gets interesting is the fact, that the stock of Alphabet, the holding company of Google is significantly cheaper than the broad market, even though it is one of the very best companies. The forward P/E of Alphabet is 19.6 vs a P/E of 24 for the S&P500. That does not even include the large cash pile of Alphabet.

The US Justice Department is pondering a breakup of Alphabet and this has put pressure on the stock. I would not worry too much, since a) such a breakup would take many years and b) the individual parts of Google might be worth more than the sum.

Alphabet’s self-driving subsidiary Waymo is doing extraordinarily well and keeps expanding into new cities. As of today, San Francisco, Austin, Los Angeles, and Phoenix are served by Waymo with Miami starting soon.

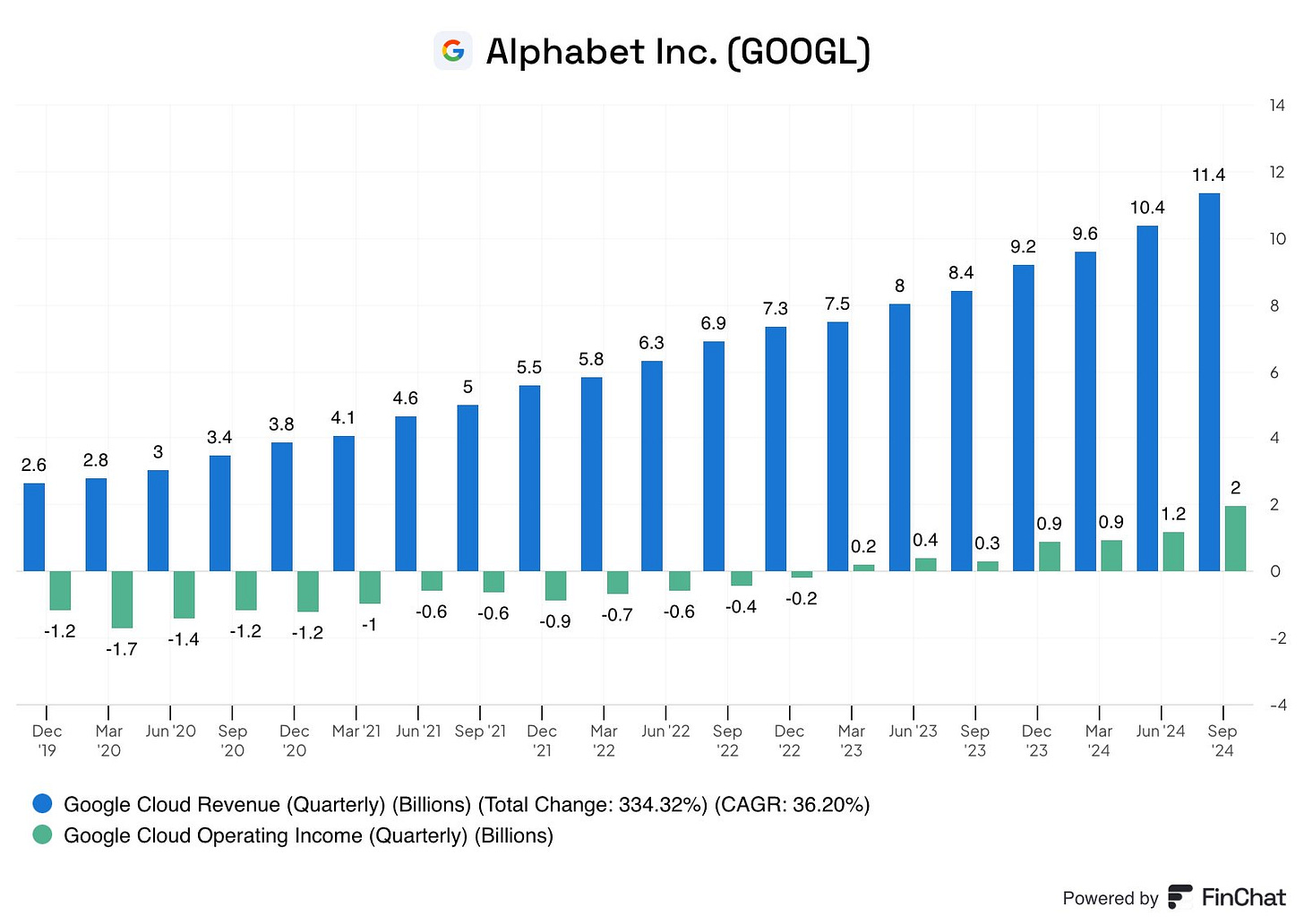

Google Cloud keeps growing both on a revenue level and even more important, the business is now contributing billions in profit to Alpahebt. Many companies would kill for owning such a cash-generating machine.

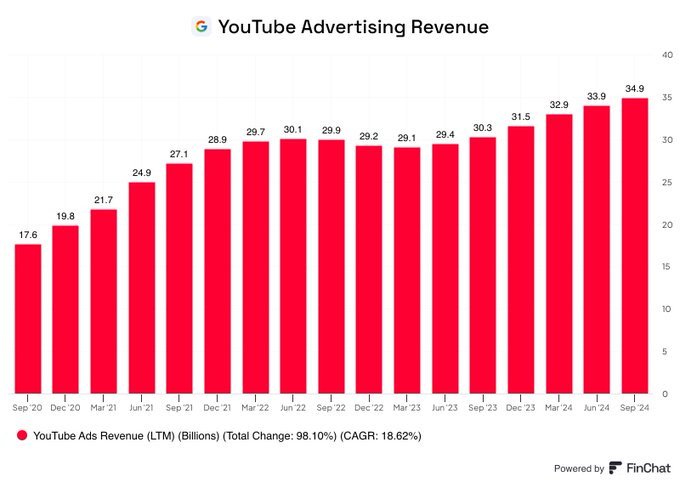

And then there is YouTube. YouTube keeps growing and I am a paying subscriber since you can’t use it anymore without being a paid subscriber due to all the ads. From Alpahbet’s point of view this is intentional: Either generate money through advertisements or make recurring revenue from paying subscribers. What a fantastic business model.

Compared to Amazon Prime, Disney+, Netflix, etc, Alphabet pays a fraction for the content. The content is generated for free by the many users and the payouts to these users are minimal compared to the revenue they generate for Alphabet.

YouTube (black) is consistently gaming market share in streaming hours of US TV time.

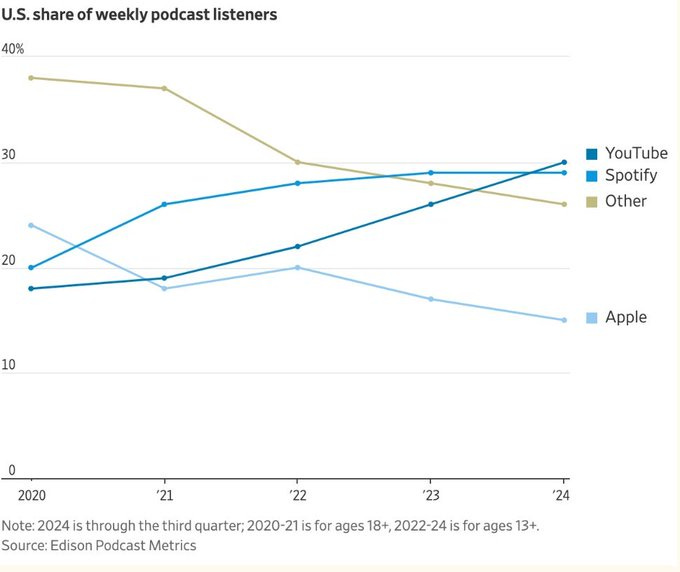

At the same time, YouTube even overtook the OG of podcasts, Spotify, to become the most-used platform for podcast listeners. The podcast industry keeps growing and so does YouTube’s relative and therefore absolute share.

All of this combined leads to an ever-increasing advertising revenue for YouTube. Considering that Google paid back in 2006 $1.65 billion for YouTube, this must be counted as one of the steals of the century.

If you sum it all up and reflect on the strength of the business and the moat of the company you would guess, that Alphabet must be quite expensive. The good news is: that the valuation is very cheap. Alphabet is currently trading at an EV/net income of 22 and forward P/E of just 19. I am aware that an EV/(FCF-SBC) of 63 does not look cheap. The current high spending on capex (most of it is AI-related) has a huge toll on the FCF. I believe, however, that this spending will increase the moat of Alphabet even further.

On a forward P/E level Alphabet is fairly cheap.

I believe in a couple of months a lot of investors will look back and will be surprised, that they missed buying Alphabet at such a great price.

ASML

Moving on to a company with an even larger moat than Alphabet. ASML is yet another marvelous company. Finally, a high-tech company from Europe, to be more precise the Netherlands. Without ASML you would not have the modern chips in your smartphone, computer, or any top-notch GPU. ASML is one of these companies that I followed for years before finally buying shares in the second half of 2022.

This video gives a good overview of ASML. Even if you know the company, it is worth your time.

Keep reading with a 7-day free trial

Subscribe to 41investments’s Substack to keep reading this post and get 7 days of free access to the full post archives.