Weekly Notes #14

Wisdom from Buffett and Munger, E-commerce, trees, dying fast, eating startups, roller coasters, a man in your ear, Bitcoin art and red beauties.

I hope you are having a fantastic week and you are looking forward to learning something!

In case you want to re-read the previous weekly notes, here is the link

If you like what you read and want to support my work, upgrading your subscription to a paid one would be amazing.

If you haven’t read my best buys for December yet, it’s your chance now. The article's timing was perfect and Alphabet GOOG 0.00%↑ has already gained 14% since. So congrats to you if you are invested.

Without further ado, let’s start:

Wisdom from Buffett & Munger

Why were Warren Buffett, Charlie Munger, and therefore Berkshire Hathaway $BRK so damn successful? A major part was their attitude towards market behavior. Charlie Munger summarized it perfectly in this short clip:

Timing the market is not a good idea. More money has been lost in predicting a recession than in the actual recession. Very counterintuitively, sitting still is often the best investment decision (as long as you buy great companies). It is a real-world example of the fable: the tortoise and the hare.

Interestingly enough, Berkshire Hathaway’s cash pile keeps growing and has reached absurd levels. There are as of today just 24 companies in the US with a higher market capitalization than Berkshire’s cash pile. Berkshire could use all this cash to buy Nike NKE 0.00%↑ , Starbucks SBUX 0.00%↑ , and Intel INTC 0.00%↑ and still have some nice pocket money left. I am very curious to know what Buffett intends to do with all this cash.

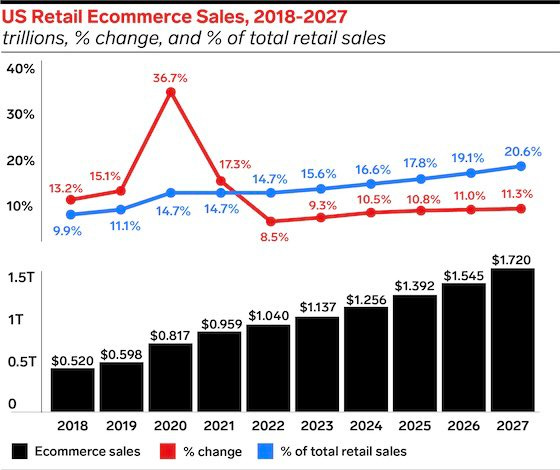

E-Commerce

The share of e-commerce sales keeps rising and is still growing at double digits. E-commerce gains market share from traditional brick-and-mortar businesses. Invest your money accordingly. My top picks in this sector are Amazon AMZN 0.00%↑ and MercadoLibre MELI 0.00%↑ .

Yes, I know: Amazon seems so obvious, but it has been obvious ever since. Investing doesn’t have to be hard. I bet most of you knew Amazon back in 2013 and thought: “It’s already so big, I’m just not sure that it can grow that much anymore. Let me invest in this new, small company with great perspectives”. Most likely the outcome was, that Amazon ate the small company for lunch and heavily outperformed most other investments. The expected growth from AWS, the advertisement business, and the planned data center chips in the future will provide Amazon with a long runway.

MercadoLibre is the largest e-commerce player in South America and so much more. Read my deep dive to learn more about this fascinating company, which is more than just a copy of Amazon.

Volkswagen

The German and in general European car industry has seen better days, to say the least. Volkswagen $VW.DE is considering closing 3 plants. This has never happened and shows the tough situation most Western car manufacturers are in: Rising costs through salary increases and rising energy prices while the cost of technical innovation also skyrockets. Management failures and stupid interesting decisions made matters worse.

At the same time, they get their lunch eaten by cheaper and quite often better Chinese EVs like the ones from Nio NIO 0.00%↑ and BYD BYD 0.00%↑ . This affects sales mainly in China (keep in mind that Mercedes sells more than 1/3 of its cars there) and will also affect sales in the EU and the US going forward. This can get ugly. Germany highly depends on its car manufacturers as a main driver for the overall industry. Expect more bad news to come from Mercedes Benz and consorts.

Distribution matters

I bet you use Microsoft Teams MSFT 0.00%↑ if you work in a larger corporation and you are not familiar with Slack. I have used both products and Slack CRM 0.00%↑ still has features that Teams is lacking. Why is it then, that MS Teams grew so much faster than Slack? The answer is (as you might have guessed from the headline): Distribution. Distribution matters a lot. Teams is given away for free or just a small fee to most companies who already use Microsoft products anyway. Combine it with an Office 365 subscription and you have the perfect flywheel. Without great execution and distribution, the best products don’t reach their customers.

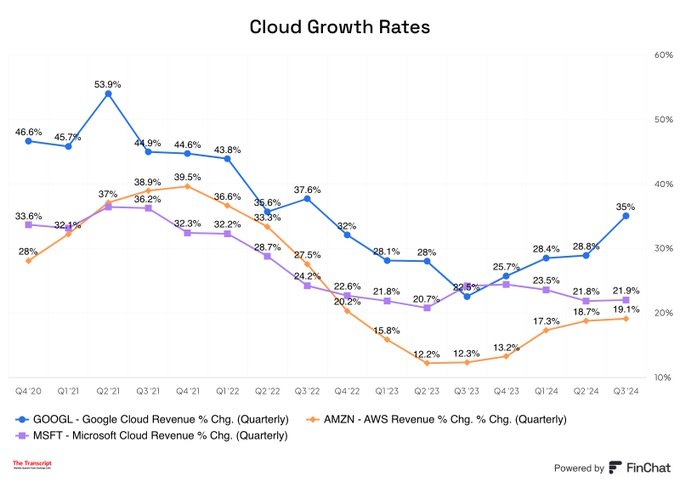

Trees growing to the sky

Trees as most living things have a natural maximum height they can reach. Another given in the past century was the fact, that large companies’ growth will slow down the larger they get. You just can’t scale hardware companies that fast.

The switch to software changed that paradigm and the sustained growth in cloud revenue seems otherworldly. Never in history did companies with the size of Alphabet GOOG 0.00%↑ , Meta META 0.00%↑ , and Amazon AMZN 0.00%↑ show continuous growth on such a large basis.

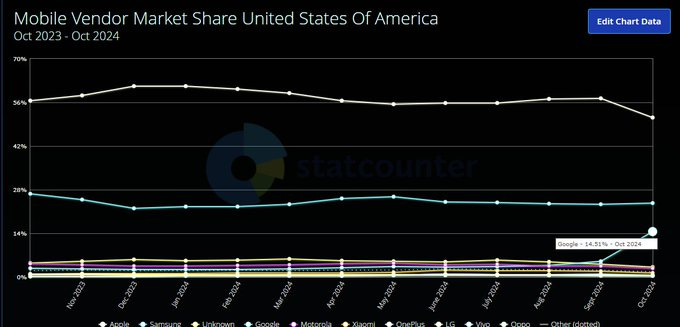

A new mobile phone player

Talking about Alphabet and Google. The new Google Pixel phones are great and have some of the very best cameras in the market. Combined with great marketing, the market share of Google phones keeps rising. You can expect this to contribute to Google’s overall growth. Have I already mentioned that I am a huge fan of Alphabet?

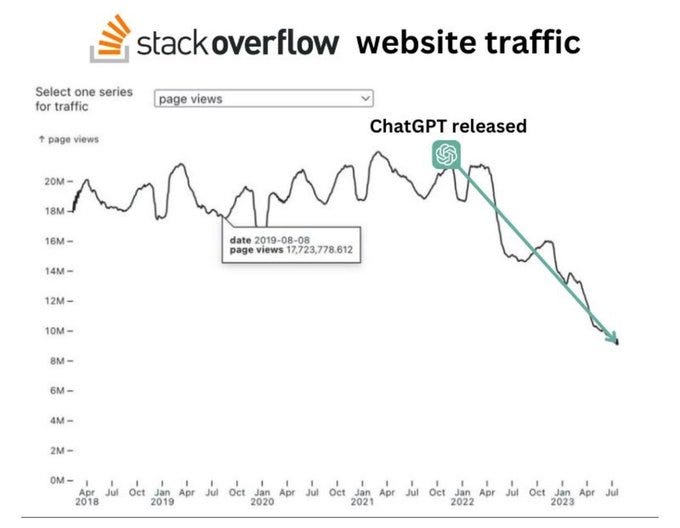

Dying fast

AI is coming whether you like it or not. There are many jokes about how AI does not understand certain topics or is still a tale of the future. Then there are some segments and companies that are impacted by AI.

One of these is the website StackOverflow which is a question-answer platform for programmers. I‘m no programmer myself but I used it from time to time to solve complicated Excel tasks and to be honest: I don’t know when I accessed the website the last time. These days I am using ChatGPT and I am very happy with the (Excel) results.

The number of page views for StackOverflow shows a similar trend. The traffic has gone down 50% since the release of ChatGPT. Some companies will feel the impact of AI only in the distant future, some die fast.

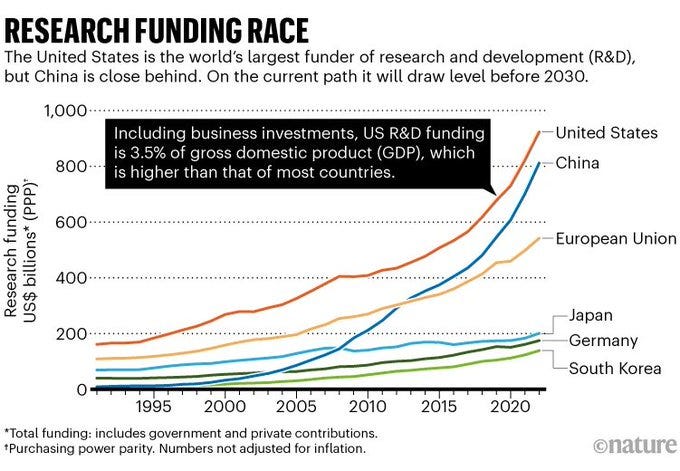

Spending on R&D

China is not only becoming a manufacturing powerhouse, but it also invests heavily in R&D. All of this money will yield more than fancy hover robots from China. Expect leading tech to originate in China in the next years. Another interesting observation: Japan is mostly flat (maybe yet another aging population issue) and Europe keeps growing. At the same time, the delta in absolute terms between the US and the EU keeps increasing.