Weekly Notes #13

American Express, Meta and the advertisement business, expensive restaurant chains, finding investment ideas, Energy Drinks and tall Chinese

I hope you are having a fantastic week and you are looking forward to learning something!

In case you want to re-read the previous weekly notes, here is the link

If you like what you read and want to support my work, upgrading your subscription to a paid one would be amazing.

Since the last weekly post, I have published my Best Buys for December. You will find them here

Without further ado, let’s start:

American Express Performance

You might know the feeling: You are researching a company, the stock is at an attractive level, and then you buy a position. Sometime later, you look at the position, and you are completely surprised by how well it did in a relatively short time frame. This is exactly what happened to me with American Express.

I knew that it was a great company and that its price was attractive at the time. I just did not expect this great performance, and I am very happy about it. I hope some of you joined me for the ride. Since the deep dive, American Express is up 85%. If you did, I would be thrilled to win you as a paid subscriber.

You can find the original article here:

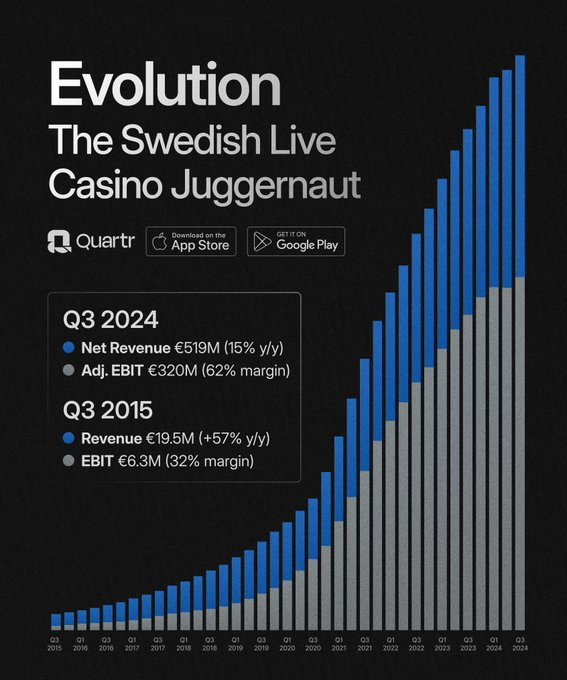

Evolution

Evolution is a fantastic company and its business keeps humming along. The stock price does not (yet) reflect the constant improvements in the fundamentals and the outstanding growth. Over time, the price will follow earnings and the stock will catch up.

A potential competitor, DraftKings, decided to close its live casino and instead will outsource to third parties. The business model of Evolution seems so simple, but its sophistication is hard to spot. There is more than just a guy/girl in front of a camera dealing you cards.

Meta / Facebook

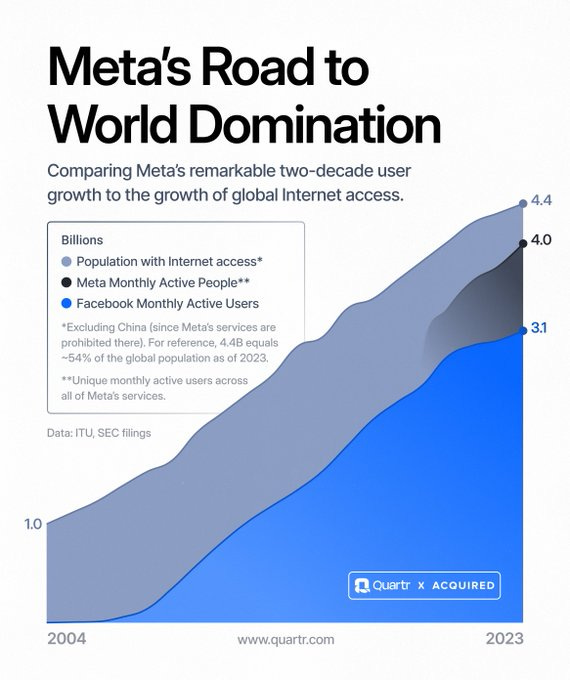

The facebook, as it was originally called has transformed itself in many remarkable ways since its founding in 2004. Mark Zuckerberg is one of the best CEOs out there, even though there were at times (hello Metaverse) questions if he would drive the company in unprofitable future endeavors.

As we learned, Zuck pivoted and trimmed Meta for efficiency. Great acquisitions such as Instagram and WhatsApp made sure that Meta stays ahead of the game and will continue to prosper many years in the future. I am a very happy shareholder and I am happy to have many more years of Zuck as the CEO.

Just as impressive as the roadmap of Meta’s product is the insane amount of users. It seems that every person with new internet access (grey line) becomes automatically a Meta user (blue line). There are now 4 billion (!) monthly active users across the Meta family of apps. That’s equivalent to the total world population in 1975. In case you lost track of where we are today: as of 2024 there are 8.2 billion people in the world.

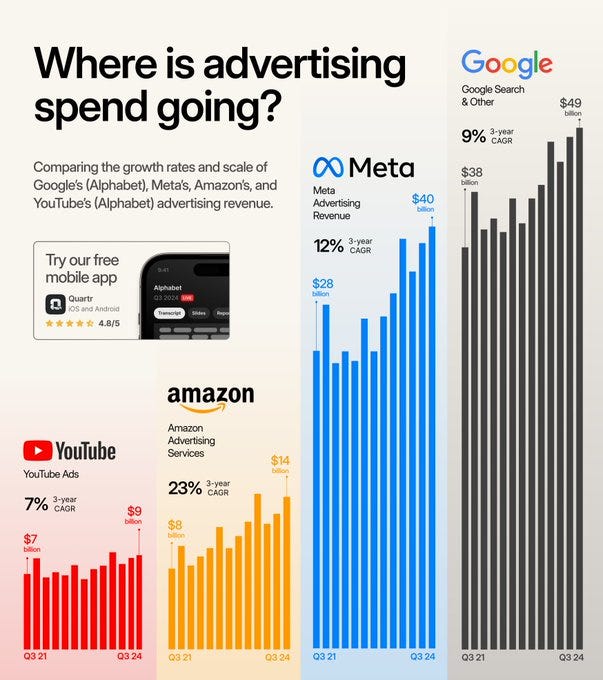

Advertisement business

As well all know, Meta makes most of its money from advertisement. The growth continues to be strong for Meta and also for the other players. Amazon has quietly become the third largest advertiser and you will see it when you are searching for a product on Amazon. The sheer number of “sponsored” products is insane and is hard to spot the actual top results.

Pay attention to the increase in YouTube’s advertisement revenue. Just another reason why I love Alphabet.

You might wonder: Was there a shift in the advertisement spent over the years, and boy you are onto something:

The internet destroyed the old print magazine business model. For Buffett, newspapers and magazines used to be one of the best business models. They had everything you wished for asset light and a huge moat in the local market. After all, there was usually one dominating newspaper in every major town.

And then came the internet... Switching from print to digital formats could only slow the bleeding but could not stop it.

Talking about valuation

We want to buy great companies at an attractive valuation. Wingstops tells a story of what happens when valuation gets out of hand even for a good business.

The P/E ratio reached levels that are just nonsense for a restaurant chain and valuation got out of hand. Why should a restaurant chain trade at a P/E ratio of 160?

When a stock is priced to perfection it sometimes takes just a small poke and you will see a drop in the share price. This is what happened with the latest earnings release. The stock dropped -21%.