Intro

Next to the behemoths Visa and Mastercard, American Express (Amex) is the third big payment company. While Visa and Mastercard’s shares go hand in hand and have been astonishing long-term investments, American Express has been lagging behind. This begs the question: Is American Express a good investment as of today?

The Company

American Express is a leading credit and charge card issuer to both consumers and businesses. I am sure most of you have seen the famous green or black American Express cards. Fun side fact: You cannot apply for the black card. The black card, also known as the Centurion Card is invitation only and rumors are that you need to spend at least $100-250k a year to be eligible for the invitation.

Amex was founded in 1850 as an express mail dispatcher and pivoted to financial services in the early 1900s. It is based in New York, employs 77.000 people, and is one of the 30 members of the Dow Jones 30, which it joined in 1982. The company has a rich history and used to have very cool paper-based stock certificates as the one from 1865 shows below:

American Express is one of the most valuable brands in the world, ranking 63rd in 2022 ahead of Visa, Ford, Louis Vuitton, and Nestlé.

The Industry

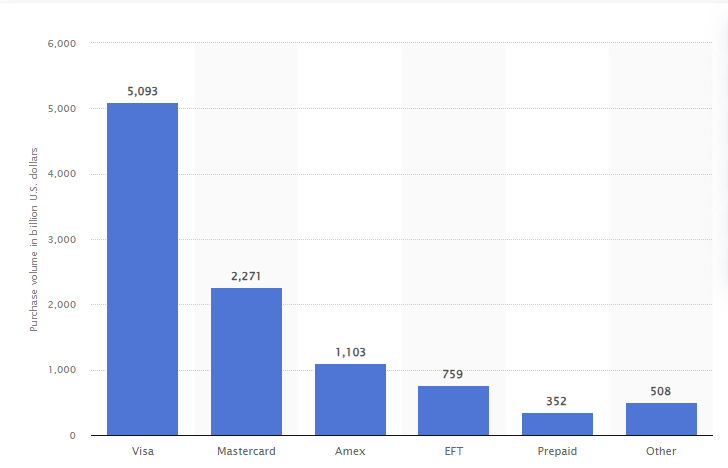

As seen in the long-term stock chart above, the incumbents of the industry are doing very well. Visa is clearly leading the pack in terms of purchase volume. Mastercard and American Express are number 2 and 3 in terms of purchase volume.

All of the payment providers have inbuilt inflation protection: When prices go up, so does the share in absolute numbers, which the payment processors take as a fee. To quote the CEO from the Q2/23 earnings call: “And you have to remember, and, you know, you guys all know this, this is a very good industry to be in.”

The global payment processing market is expected to grow with a CAGR of 12% in the next 10 years. Further growth in e-commerce share will add to the underlying growth trends. Covid has also accelerated the acceptance of payment by credit card in comparison to cash.

The Business

Amex's business is centered around its own transaction network.

There are 122m American Express cards in circulation, of which 56m are based in the US. The average cardholder spends $23k with the Amex card per year (!). The goal is to be the leading premium card issuer with an attractive value proposition for its users and partners. Due to the annual fees, customers are more likely to make purchases with their Amex card in order to get the benefits of their Amex.

The company is split into 4 segments: U.S. Consumer Services (USCS), Commercial Services (CS), International Card Services (ICS), and Global Merchant and Network Services (GMNS).

Card Issuing Businesses

The goal is to acquire and retain high-spending and credit-worthy cardholders through cash-backs, partner relationships, and dedicated customer service. One of the focus points is to attract more Millennials and Gen Z clients. In 2022 there were 76.7m proprietary cards in circulation. Amex charges high annual fees for its cards. For example, the Platinum card costs 695$ a year and gives multiple benefits, as shown in the picture below.

Global Merchant and Network Services (GMNS)

The main goal is to manage existing merchants and sign new merchants to accept Amex cards as a method of payment. Merchants sign individual discount rates and are being offered fraud prevention, marketing solutions, and data analytic insights into their customers.

Card Network Business

Amex runs its own card network. Third-party banks and other institutions in 103 countries are part of it and can issue Amex-branded cards in the local currency. In 2022 there were 56.5m cards issued by third parties in circulation and the total spend from these cards was $214bn. The most important partner is Delta Airlines and co-branded cards between Delta and Amex represent 10% of the global network volume. As part of this relationship, Amex customers have large benefits when using Delta services, such as airport lounge access for certain card members.

American Express converted into a bank holding in the financial crisis in 2008 and therefore falls under banking regulation. The effective minimum for the common equity tier 1 ratio is 7% and Amex strives to stay between 10 and 11%. The common equity tier 1 is made of liquid holdings such as cash and stock. The plan of Amex is to distribute excess capital to shareholders in the form of dividends and share buybacks. In 2022 $4.9bn were returned to shareholders with 1.6bn in dividends and 3.3bn in share repurchases.

If you want to read the full article and learn about the management, the composition of the segments, takeovers, risks, fundamental analysis, and a conclusion please subscribe and support my work. To all existing subscribers: Thank you for your support and enjoy the rest of the article!

Keep reading with a 7-day free trial

Subscribe to 41investments’s Substack to keep reading this post and get 7 days of free access to the full post archives.