The difference between a good and a great company: part 1

Good vs Great companies: Choose wisely

Intro

Welcome to this three-part series that teaches you about the changes that I made to my watchlist in recent months. This is part 1 where I talk about companies that I reevaluated, part 2 will cover companies that I removed, and part 3 is about companies that are fairly new to this list.

I have a list where I track the quarterly earnings of about 150 companies that I identified as truly outstanding or, in the sense of the headline: great companies. You will learn in this article about some companies that I have taken off my list, some companies I have changed my mind on, and some companies I have newly added.

This watchlist is not set in stone, and I add new companies and remove some others that no longer fulfill my criteria. To be included in this list, a company must show very strong fundamentals. Price is not a criterion for inclusion.

There are some companies on the list that I think very highly of, but would not buy at the current price. One of these is Costco. A fantastic company in every aspect, but it is just too expensive at this moment.

In regard to “expensive”, I am not talking about the stock price itself. Some people might say that $990 for a single share is too much, but they just miss the point that it does not matter if you buy one share for $990 or 10 shares for $99. In regard to being too expensive, I'm also not talking about the fact that Costco is near an all-time high. A company that is trading at your near all-time high can still be reasonably priced if the fundamentals are strong and growing.

At this moment, Costco is trading at an EV/net income of 55 with an expected EPS growth of 15% in the next years. This is what I refer to as too expensive. It’s all about the valuation of the company at the current point in time. Looking at its historic valuation, Costco is trading at the higher end of its historic P/E ratio.

Having said that, I believe that Costco stock might continue to rise in the next weeks and months, but for me personally, there are more interesting stocks out there. One of them is Arista, which is both faster growing and cheaper than Costco at the moment. Learn more about Arista here:

Another company that is very interesting right now is AMD. Find the full deep dive here:

If you wonder what other companies are on my watchlist, you will get a good feeling based on my deep dives. Those companies are in a league of their own. You will find a couple of the stocks that I hold in very high regard in this article:

Coming now to the main part of this article: Companies that I changed my mind on in recent months. I regard those companies now as good, but not great companies:

Companies that I reevaluated

Home Depot and Lowe’s

Both companies operate in the same field, namely home improvement retail, and are direct competitors. Both companies have a very strong track record and have proven to be good investments and companies. If you are not a good company in the long term, your stock will not rise in the long term. Purely based on this chart, you know that you are looking at a good company.

Home Depot is very much the same as Lowe’s. Both price charts show the same pattern, with a steady increase until the COVID-19 crash of 2020, a spike in the price, and a consolidation ever since.

To keep things simple, I will focus on Home Depot from here on since there is really not that much of a difference between the two companies. In case you have never been to the US, a Home Depot looks like any other home improvement store.

Based on my wording above, you might have recognized that I said both Lowe’s and Home Depot look like good companies and investments. I have not said great on purpose. Let’s have a look at the fundamentals to learn why:

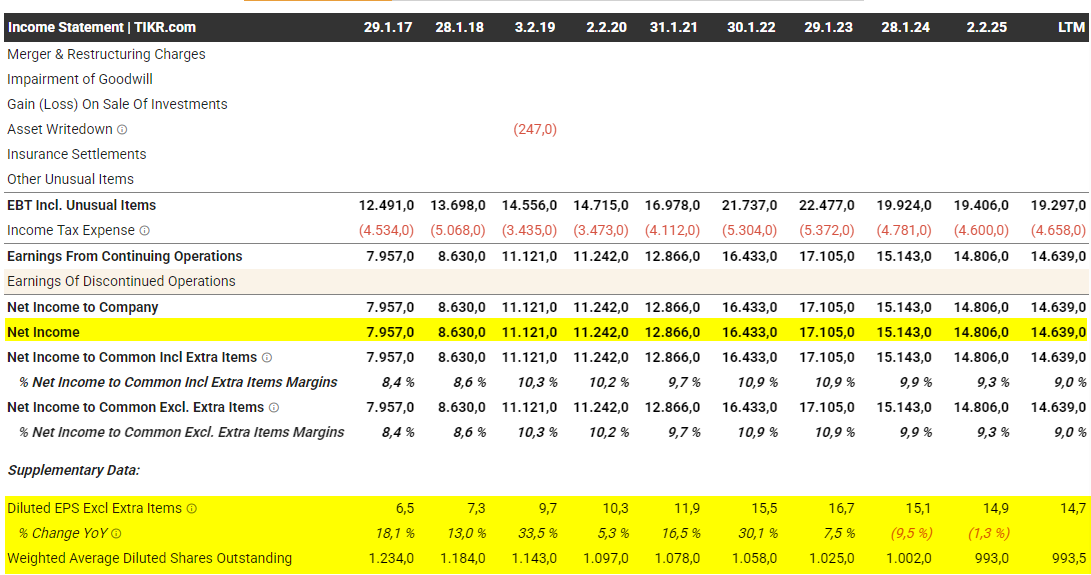

Revenue growth is certainly present. We were mostly looking at a growth rate in the mid-teens for the last years, with the exception of the Covid years. As was the case with many other consumer-facing companies, some revenue and therefore growth experienced a pull-forward effect in 2020-2021. People were stuck at home and used their discretionary income on improving their homes instead of going on vacation or to restaurants. As a result, the revenue growth slowed down in 2022 and decreased in 2023. The gross margins are mostly stable (albeit very slightly declining).

The operating expenses (mostly the staff) increased faster than the gross profit (that is, revenue minus the cost of goods sold). This led to a decline in the operating margin from 14.2% to 13.5%. Another negative factor is the increased interest rate expenses. That is the interest Home Depot pays on its debt.

The net income of Home Depot has shown a good growth trend, nevertheless. As a result of the strong share buybacks (the number of outstanding shares decreased by almost 20% in the last 9 years), the earnings per share more than doubled (6.5 to 14.7). As I said before, we are looking at a good company here. If you invest money in Home Depot, I am sure that you will have a positive return over many years.

What I don’t like about Home Depot is the increasing ratio of long-term debt to cash and short-term investments. The dividends and the stock repurchases come at a price. All the money that is generated by the business is either spent on Capex (money that you need to invest to keep the company running) or on dividends and share buybacks.

Some of the revenue growth is coming from inorganic growth due to acquisitions. One of these (expensive) purchases was SRS Distribution, costing $18.3 billion. Without these takeovers, the revenue growth would be even lower.

The Free cash flow of Home Depot has been mostly stagnating as a result of non-growth in the net income and increasing capital expenditures to maintain the stores.

The expected EPS growth in the next years is ok/good, but not great.

Considering all these factors, Home Depot is a good company, but not a great company. The growth in earnings per share is purely a result of the strong share buybacks. Realistically you can expect a return on your Home Depot stock of ~10% per year coming from the earnings per share increase and the dividend that is currently at 2.5%.

So, what do we do with good but not great companies? I would not buy and hold them in the long run, since I want my money to be invested in the very best companies. What you can do, however, is to buy them when they are very cheap and then profit from a bounce back to a normal valuation level. In Home Depot’s case, that would be a low-teens P/E ratio. At today’s level, Home Depot is certainly not at such a point.

A company that is a good but not a great company, and was very cheap, was Expedia in 2023. Earlier this year, you were up 100% in just 1.5 years, and you are still up 60% today if you followed my reasoning. I marked the release of my article in the chart below:

You can read the investment thesis here:

Airbnb

Moving from one travel company to another, we are coming to Airbnb. I was, for a long time, a fan and customer of Airbnb. Back in the day, Airbnb was a great and cheap alternative for me as a student to travel around, both in Europe and the US. It was also the only platform where you could find a place to rent for a larger group. I have fond memories of renting a whole house in Galway, Ireland, for St. Patrick’s Day. If you haven't been to Ireland on St. Patrick’s Day, make sure to add it to your bucket list. It is fantastic!

If you want to learn why I changed my mind on Airbnb, please subscribe to support my work.

To all existing subscribers: Thank you for your support! :)

Keep reading with a 7-day free trial

Subscribe to 41investments’s Substack to keep reading this post and get 7 days of free access to the full post archives.