Arista Networks Stock Analysis & Deep Dive

If you want to benefit from the large CapEx on AI, make sure to continue reading

Intro

May is coming close, and so is my annual trip to Omaha. I am attending an investor conference in Omaha, and one requirement (and the fun part) is to pitch one idea. As a preparation, I went through my watchlist of more than 100 great companies to decide which one I will present this year.

Arista Networks is the name of the game, and I have been following the stock for years without buying any shares. Now is finally the time for Arista Networks to trade at an attractive valuation, and the fundamentals still look fantastic.

It is time for a deep dive. Please put on your snorkel and let’s explore the fantastic underwater world. As a side note: More than 10 years ago, I was in Australia diving in the Great Barrier Reef, which is still one of the most fascinating experiences I have ever had. The sheer explosion of colors and things to see blows your mind. If you find the time, make sure to explore this miracle while it still exists.

The Company

Arista was founded just 20 years ago by Andy Bechtolsheim (fun fact: he is German and his full name is: Andreas Maria Maximilian Freiherr von Mauchenheim genannt Bechtolsheim), Kenneth Duda, and David Cheriton. These are the three gentlemen:

Andy Bechtolsheim is one of the co-founders of Sun Microsystems. Sun Microsystems was acquired by Oracle in 2010. After leaving Sun, he founded the company Granite System which focused on high-speed Ethernet switches (you can see a pattern here). Granite was taken over by networking giant Cisco in 1996. In 2001 he founded Kealia with David Cheriton to work on advanced server technologies. Kealia was bought by his former company Sun and he returned to Sun before he founded another company with his partner David Cheriton. This company was named Arista.

David Cheriton is a Canadian computer scientist and professor at Stanford University. He founded more than 20 companies and is just like Bechtolsheim very wealthy with a couple of billion dollars. Bechtolsheim and Cheriton were two of the earliest investors in Google. When founding Arista they set their goal to build Ethernet switches that could handle the upcoming demand for ultra-fast switches with the rise of cloud computing. And boy did they bet on the right horse.

11 years ago, in 2014 Arista had its IPO and joined the S&P500 in 2018. Since the IPO, Arista’s shares have risen more than 1700% even though the company is down 42% from its all-time height. Arista Networks began to ship its products in 2008 and has grown into a company worth $92 billion (as of early April 2025). All this is achieved with a workforce of just 4400 people. Arista serves more than 10,000 customers with a combined 100 million ports of install base.

This is how Arista Networks introduces itself in its annual report:

Arista Networks is an industry leader in data-driven, client-to-cloud networking for large AI, data center, campus and routing environments… At the core of Arista’s platform is Arista’s Extensible Operating System ("EOS®"), a modernized publish-subscribe state-sharing networking operating system

To say it in layman's terms: Arista is designing and selling high-performance network gear and the software needed to run and maintain these networks. Customers include everything from telecommunication and large corporations to (AI) supercomputers and cloud data centers. All those customers need fast and reliable networking gear. Arista’s EOS software turns the “dumb” hardware into smart computers and makes the whole network better scalable and maintainable. Arista has been on a remarkable journey and the revenue growth has been simply fantastic.

This video is a great introduction to Arista’s 10-year journey since the IPO in 2014:

The Industry

Traditionally, this industry has been dominated by a few large vendors. Cisco is the main incumbent in the data center and campus networking market. Other large players include Dell, Extreme Networks, Hewlett Packard, Huawei, and white-box networking vendors. White box hardware refers to off-the-shelf, standardized, non-branded components that usually run on open-source network operating systems. Their main benefit is a cheaper price compared to branded networking equipment. The industry has seen consolidation in recent years, as the larger market players continued to buy smaller players. Jayshree Ullal made the following comment toward white box hardware providers:

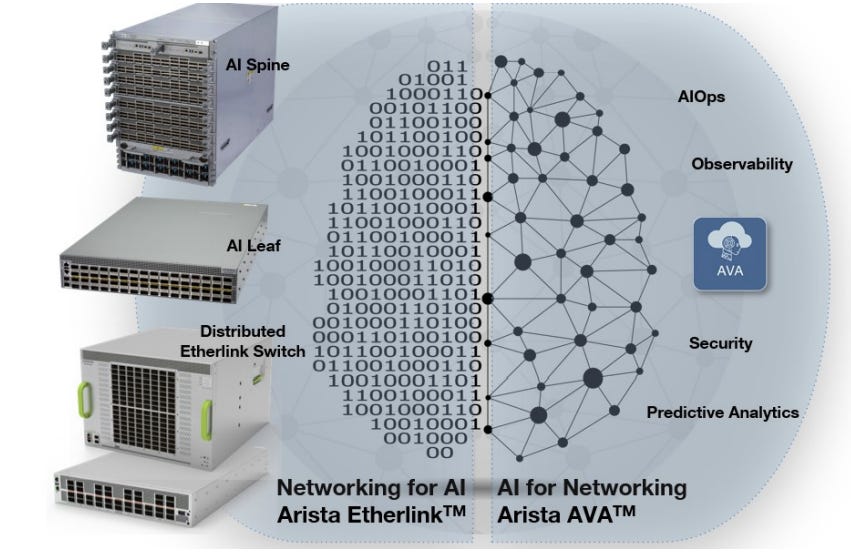

We will always coexist with white boxes and operating systems that are non-EOS, much like Apple coexists on the iPhone with other phones of different types. When you look at the back end of an AI cluster, there are typically 2 components, the AI lead and the AI spine… The AI lead connects to the GPUs and therefore, is the first, if you will, point of connection. And the AI spine aggregates all of these AI leads. Almost in all the back-end examples we've seen, the AI spine is generally 100% Arista-branded EOS. You've got to do an awful lot of routing, scale, features, capabilities that are very rich that would be difficult to do in any other environment. The AI leads can vary.

This is the 2013 Gartner Magic Quadrant for data center networking infrastructure. Arista was listed as a visionary, but its execution ability was quite low. Huawei was also on the list, but its vision and execution ability were quite low.

Fast forward 12 years to 2025 and the landscape for data center switching changed dramatically. Huawei made a massive jump and became the leading visionary. Arista is now the leading company in terms of execution ability while still rating very high in terms of vision. The US government and the European Union have banned the use of networking hardware from the Chinese company Huawei. These actions favor Western players such as Arista Network. At the same time, the Chinese government is issuing bans on Western companies such as Arista. With 82% of all revenue coming from the Americas, Arista is a winner in this scenario.

As you can see in the chart below, Arista is crushing the competition when it comes to revenue growth.

This strong revenue growth is due to a growing market and gained market share by Arista in recent years. Today, Arista has the highest market share of any company in data center switching. Cisco once owned 80% of the market dollars for high-speed data center switching in 2012, but it was finally overtaken by Arista in 2024. The same happened in the share of ports, with Arista becoming the dominant player in 2024.

Arista expects to have a total addressable market (TAM) of $70 billion by 2028 and a split of 1/3 AI, 1/3 data center and cloud, and 1/3 campus and enterprise. The company's top three customers are deploying a combined 100,000 GPUs, each worth $25,000. All those GPUs want to be properly connected, and Arista sees huge potential in this market.

Ethernet, InfiniBand, and networking technology

Some words on Ethernet and then InfiniBand followed by a short explanation of modern networking technology, since this term will come up quite a lot in this article:

Ethernet is the most common technology to link servers, computers, and other devices together in a network. This can happen in more local instances like your home, or a larger setting like a big corporation. The Internet as a whole is made up of countless Ethernet networks that are connected by routers. When I hear the term Ethernet, the first image in my head is one of these LAN cables.

This brings back some good old memories of the LAN parties I joined as a teenager. The picture below is taken from the internet, but our LAN parties look very much alike. You had to bring your big and heavy CRT monitor and your tower computer to your friend’s house and connect all the computers with the aid of above mentioned LAN cable to a switch to play together. Those were the golden days of gaming (now I feel old saying this).

Fast-forward a couple of years, and most of you (myself included) own a laptop and at least one smartphone that is always online. Usually, these devices are connected via the mobile network or Wi-Fi (Wireless Fidelity) to a router, which is connected to the internet.

The switch we used for gaming back then is, in principle, similar to those built by Arista Networks today. Of course, Arista's switches are way more advanced and sophisticated. Arista specializes in building ultra-fast switches, up to 800G (that is 800Gbit/s). These fast switches connect thousands of servers in AI clusters and cloud platforms. They are needed to enable the east-west flow between thousands of GPUs while keeping the amount of cable, space, and heat low.

InfiniBand

InfiniBand is a competing technology for the broadly adopted Ethernet. While Ethernet has been around for a while and is used in a wide variety of use cases, Infiband was originally developed for supercomputers. Nvidia is the clear leader in this technology thanks to the acquisition of the company Mellanox in 2020. While InfiniBand is superior in AI use cases it lacks the flexibility of Ethernet. On top of that, the management of InfiniBand is a lot more complex and the whole ecosystem is dominated by Nvidia. That is fine as long as the customers don’t mind being bound to one supplier. With the newest 400G and 800G switches, Ethernet gained ground on InfiniBand and it is easier to scale in large cloud settings.

Networking technology

Before we continue with the next part, some words on spine and leaf architecture: A two-tier spine-leaf architecture is the new standard for creating high-performing and scalable networks. The leaf switches are connected directly to the server, while the spine is connected to every leaf but not to each other. Through this architecture, each device is just one step away.

Traditional networks on the other hand have a high-speed core backbone (the highway) connected to an aggregation layer (the normal road) that directs the traffic. At the bottom of the graph, you see the access points (a local neighborhood to stay with the road analogy). These are your devices like computers and smartphones. This setup is easy to manage and made perfect sense, as long as most traffic was user-to-server based (north-south).

In today’s world of fast-growing networks, and server-to-server communication (especially for AI cases) you want your network to be more flexible and enable east-west traffic. Another benefit is the almost endless scalability of the Spine-Leaf architecture and the fact that there is no single point of failure since everything is redundant.

As you can see in the image above, every leaf must be connected to every spine switch. This in turn demands a lot more cables and also switches. This is great for a company like Arista, that sells the hardware. Modern server racks can be a thing of beauty if done the right way.

CEO Jayshree Ullal pointed out the dominant position of Arista in connecting the GPUs that are needed for AI training:

First of all, when you're buying these expensive GPUs that cost $25,000, they're like diamonds, right? You're not going to string a diamond on a piece of thread. So first thing I want to say is you need a mission-critical network, whether you want to call it white box, blue box, EOS or some other software, you've got to have mission-critical functions, analytics, visibility, high availability, et cetera. As I mentioned, and I want to reiterate, they're also typically a leaf spine network. And I have yet to see an AI spine deployment that is not EOS-based.

I'm not saying it can't happen or won't happen. But in all 5 major installations, the benefit of our EOS features for high availability for routing, for VXLAN, for telemetry, our customers really see that. And the 7800 is the flagship AI spine product that we have been deploying last year, this year and in the future.

So in my view, it's difficult to imagine a highly resilient system without Arista EOS in AI or non-AI use cases.

The newest 7800R4 Spine can do 800 gigabits per second Ethernet, which is crucial for AI networks. Arista often mentions the five AI titans: Microsoft, Meta, Alphabet, Amazon, and Oracle. These titans are a major driver of Arista's growth. Arista has a very good standing with the top five AI titans, which matters greatly when looking at the Ethernet switch data center revenue forecast for the next years.

The Business

Arista groups its portfolio into three categories: Core (Data Center, Cloud, and AI Networking), Cognitive Adjacencies (Campus and Routing), and Cognitive Networks (Software and Services).

The largest customers of Arista are Microsoft and Meta, both contributing more than 10% of overall revenue. Microsoft’s share of revenue increased to 20% of total revenue in 2024 (increasing from 18% and 16% in the years prior). Meta’s share was 15% in 2024 (down from 21% and 26% in 2023 and 2022). Meta’s decline in relative revenue was due to the “year of efficiency” at Meta and the successful switch towards 400G Ethernet. To put Meta’s decline into perspective, Arista Network’s revenue has increased steadily over the last few years. 26% of 2022 revenue totals $1.14 billion, while 15% of 2024 revenue totals $1.05 billion. In absolute terms, the decrease was “just” 8% and far from the implied drop based on the relative revenue share. Meta is a very important customer of Arista and both companies have done multiple generations of codesigns for Ethernet switches.

Benefits for the customer include network monitoring options, encryption, configuration automation, and scalable architecture to keep the total cost of ownership low. Arista is aware of the importance of always having up-and-running networks, and updates are installed so that the servers are never offline.

So what are Arista's main market drivers?

Digital Transformation

Business operations depend more and more on their networks daily, and topics such as network availability, performance, security, and ease of use in terms of programmability and operational simplicity are crucial. It is important to have access to your data and to make the data available across the whole enterprise.

Cloud computing is a main driver and beneficiary of these developments, and many companies are moving crucial operations online (i.e. in the cloud). The option of scalability and operational cost efficiency are the main drivers. The beauty of technology is, that it gets outdated over time. This in turn makes happy customers also repeat customers. CEO Jayshree Ullal talked about this in the Q2/2024 earnings call:

we are going through a refresh cycle where many of these customers are moving from 100 to 200 or 200 to 400 gig. So while we think AI will grow faster than cloud, we're betting on classic cloud continuing to be an important aspect of our contributions.

Artificial intelligence (AI)

AI workloads are both data and compute-intensive. While we are speaking on the topic of AI, Make sure to read my AMD deep dive:

AI workloads involve hundreds of processors (CPU and GPU) with large computations across high-bandwidth networks. This drives the need for standardized transportation, such as Ethernet, to make this magic possible. Arista helps by providing network-switching products. The new 800 gigabit Ethernet is expected to emerge as an AI back-end cluster in 2025 and Arista aims to achieve $1.5 billion in AI center revenue in FY 2025.

Hybrid Work

I am sure you know many people who don’t work five days a week from their corporate desks. The challenge is providing remote workers with the same access as those at the location. Smart devices and the Internet of Things (IoT) add further endpoints that must be connected to the once-encompassing campus. Security needs and availability are must-haves in this scenario.

Zero Trust Networking Security

A fancy term that means you do not trust any device, even if it is already in the network. Cyber threats are on the rise, and Arista helps its customers with securing their digital parameters based on its digital platform “EOS”

This quote defines very well why Arista ran into open doors with its technology:

Traditional enterprise networks have been mired in complexity, proprietary features and architectures, custom ASICs, siloed designs, and fragile software offerings built up over the previous three decades. Because of this, operating a legacy network is riddled with challenges; critical outages that cause risk-averse behaviors, labor-intensive rollouts that impede business initiatives, limited visibility that prevent problem detection and isolation, and overall lack of automation and uniformity that results in inefficiency… In addition, there had historically been little or no attempt to address the needs of building and operating a network infrastructure at massive, cloud scale. As a result, as enterprises moved applications to the cloud and implemented hybrid and multi-cloud strategies, there have been insufficient solutions that could configure, deploy, automate, and manage these scaled and dispersed resources.

EOS software

One of Arista’s best selling points is its EOS software. EOS runs on a Linux basis and is included as a license on Arista hardware platforms. Its open architecture and many APIs offer its customers an open, standard-based environment. Arista’s cloud networking platform enables data center networks to scale hundreds of thousands of physical and millions of virtual servers while keeping switching tiers to a minimum. The rise of AI will continue to push the demands on networks, and Arista is perfectly positioned to profit from this trend. A main benefit of Arista’s EOS software is the feature consistency across the whole product portfolio. This enables Arista to update the software stack faster than its competitors, resulting in six EOS software releases in 2024.

Production

Manufacturing of the products is outsourced to contract manufacturers. The most important manufacturers are Jabil Inc (US), Sanmina Corporation (US), Flex Ltd (Singapore,) and Foxconn Hon Hai (Taiwan, but mostly operating in China). You will know the name Foxconn from Apple. Foxconn is the main manufacturer of Apple products.

In the past, outsourcing of manufacturing would have been an interesting fact. In times of tariffs and political uncertainty, we need to dig deeper: Jabil mostly manufactures in China and Mexico (bingo and bingo). Sanmina all over the world, Foxconn with a focus in China. It is hard to find any information on the share of products manufactured in China. Arista has taken steps in the last few years to diversify its manufacturing to locations outside of China. Mainly to Vietnam, Thailand, Malaysia, and Mexico.

Interestingly, Arista was writing about a potential trade war between China and the US already in its 2020 annual report:

The supply of components may also be adversely affected by geopolitical conditions such as international trade wars like the U.S. trade war with China and the impact of public health epidemics like the coronavirus currently spreading around the world.

This is the phrase adopted for the 2024 annual report:

The supply of components may also be adversely affected by geopolitical conditions such as escalating tariff and non-tariff trade measures imposed by the U.S., Mexico, China and other countries present in our supply chain.

Sales channels

Arista uses merchant silicon (standardized third-party silicon chips) to adopt new trends early and keep prices low. Arista has four distribution centers based in the US, the Netherlands, and Singapore. Arista sells its products directly via channel partners, including value-added resellers, system integrators, distributors, and OEM partners. An important point is, that the partners do not stock inventory independently. As soon as they receive an order, the partner informs Arista and Arista confirms the identification of this customer before accepting an order. This has two main benefits: 1) Arista knows all its customers and if one customer would turn into a very important player, Arista can serve this customer directly. 2) overstocking on behalf of the partners is limited. Some companies such as the energy drink company Celsius suffer through the ups and downs of its distribution partners. This leads to a very unpredictable sales forecast and declining revenues when said partners have stocked too much inventory.

Regarding regional revenue distribution, the Americas is leading by a wide margin. At the same time, the Americas region also posted the highest growth in the last year.

The Products

The main products of Arista are Ethernet switches, routers, the EOS software (operating system for switches), the CloudVision software (management platform to automate and monitor networks) as well as optics and cables. Arista made itself a name by becoming one of the main suppliers of backend solutions. Backend solutions enable the infrastructure of cloud and data centers. All of this happens inside the network and is focused on cloud, AI, and hyperscaling use cases. Products include

data center leaf and spine switching that enables east-west traffic between servers, GPU, and storage

routing solutions to move data between data centers

AI networking to link thousands of GPUs

In the last years (since 2020) Arista also moved towards the frontend. Frontend in this case is all about products that connect users, devices, and smaller networks. Here Arsita offers

campus networking switches and Wi-Fi for local environments such as offices

zero-trust networking

Management of the infrastructure through the software CloudVision

This sentence by John McCool summarizes nicely how Arista thinks about its positioning in the market.

We're the only provider that can play both in the back end and the front end networks in a substantial way.

Core Data Center/Cloud/AI

Writing this article took me more than 60+ hours to get a proper understanding of the company and the attributes of the industry it is working in. If you want to learn more about the products, the management, existing risks, the fundamentals, the valuation, and my conclusion please subscribe to support my work.

To all existing subscribers: Thank you for your support! :)

Keep reading with a 7-day free trial

Subscribe to 41investments’s Substack to keep reading this post and get 7 days of free access to the full post archives.