Weekly Notes #15

Making money in dating, tougher comps, why retail is hard, David's maxims, getting to know your postman, musing of Steve Jobs and Kermit the frog.

I hope you are having a fantastic week and you are looking forward to learning something!

In case you want to re-read the previous weekly notes, here is the link

If you like what you read and want to support my work, upgrading your subscription to a paid one would be amazing.

Since the last weekly post, I have published my deep dive on AMD. AMD is a fantastic company and quite attractive at the current level. If you want to learn what makes AMD great and you are also keen on learning about the chip industry, make sure to read the article.

AMD Stock Analysis & Deep Dive

Intro When it comes to AI beneficiaries and hardware for AI applications, NVIDIA has gotten all the spotlight. NVIDIA’s share price has significantly contributed to both the S&P500 and the NASDAQ this year and the earnings releases have become a true media spectacle. But today we will not talk about NVIDIA, instead, we will focus on AMD. AMD has long been in the large shadow of Intel but has recently surpassed Intel in both market cap and fundamental performance. At the same time, AMD has taken large steps to become one of the dominant players in the (AI-) data center market and it is time that we take a look at AMD.

Without further ado, let’s start:

Making Money in the dating business

Given the total number of singles and non-singles on all those dating apps, you would expect that it is a fantastic business with all those people paying for extra benefits. Tinder Plus starts at $24.99 a month and Tinder Premium comes in at $49.99 a month. I hope the users get some benefits out of it.

Nevertheless, making money in the dating business is hard, at least for the big players Tinder and Bumble. There are too many alternatives and if you have a good product, your customers are not repeat customers, since they found what they were looking for (true love). The number of total payers at Match, the holding company behind Tinder, has been steadily declining after its Covid boost.

The stock price of its largest competitor, Bumble, is straight from hell. Always keep in mind: Don’t invest in IPOs.

Tougher Comps

A lot of companies experienced great growth and catch-up after the pandemic. One of these companies was AirBnb. Now the comps with the previous quarters are getting tougher and the crazy spending freeze after the Covid years is over. Just look at the drop in year-over-year growth.

I used to like Airbnb as an investment but given the recent lackluster quarters, I’d rather invest my money in other ventures. Some more details on the last quarter:

Even though the revenue for Airbnb was up 10% YoY for Q3 and +12% YTD vs 2023, the EbT was up just +3% for the quarter and +9% YTD. Net income in 2023 was impacted by positive tax effects and therefore the view on the earnings before tax is more important. The costs are rising quite fast and the large SBC continues to dilute existing shareholders. Given the current valuation, I believe that you will find more interesting opportunities out there. I'm surprised that the stock initially jumped so much after hours after the last quarterly report was published. Probably the traders misread the report.

Stock repurchases

When a company generates a surplus of cash and uses these funds to buy back shares, it is usually a good sign, if a) the company does so without getting into too much debt and b) the stock is at an attractive price. Some companies just buy back shares for the sake of doing so.

Then some companies hand out a ton of SBC and therefore show inflated FCF numbers. If they then even claim how great their FCF is and how much money they are returning to their shareholders, I get suspicious. That is exactly what is happening at Pinterest. The company spent more than $5 billion on share buybacks and at the same time, the number of outstanding shares is higher than before they started buying back shares 2 years ago. Considering the current market cap of $21 billion, one might wonder why they just blew $5 billion out of the window.

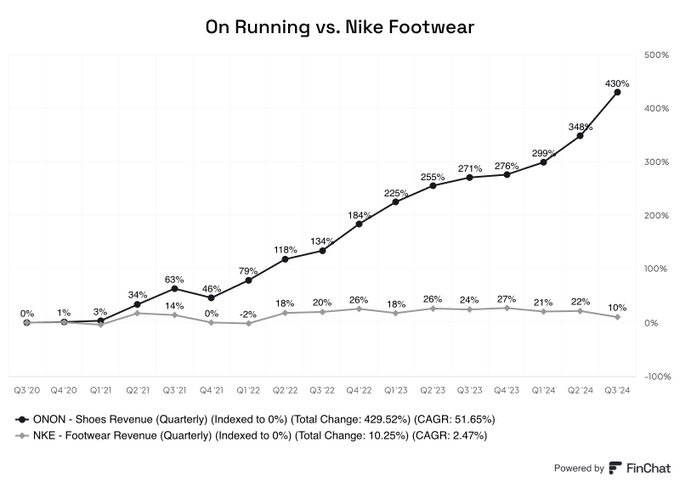

Why retail is hard

Investing in retail is a tough game to play. Customers change their tastes a lot faster than corporations do and what is fashionable today might be outdated tomorrow. That is one of the reasons, why I avoid retail as an investment. A new competitor like ON or Hoka will regularly appear and chase your customers. This is one of the reasons, why Nike and Adidas are struggling these days.

If however, you are one of these people spotting a trend, investing in retail can be a very lucrative undertaking. You probably know the shoe brand Hoka, which can be seen everywhere these days. In 2012 Deckers bought Hoka for just $1.1 million and today generates more than $1.4 billion in revenue from Hoka. A genius move. So keep your eyes open for new trends and maybe you find a nugget.

If you decide to invest in retail, make sure to read what Joel Greenblatt (one of the greatest investors) has to say about investing in retail

Going to the moon with Bitcoin

Talking about interesting stock charts: The chart of MicroStrategy is otherworldly. In 2020 MicroStrategy started investing its liquidity in Bitcoin and boy it has been a ride. I would not touch the stock since the house of cards might collapse at any moment but it sure is fun to watch it from the outside.

MicroStrategy took on debt and issued shares and then used the proceeds to buy more Bitcoin. This works fine, as long as the price of Bitcoin is rising. Once there is a major correction in the Bitcoin price (yes, they always come) things get interesting. It’s generally better to watch bubbles from the outside than participate in said bubbles.

David Senras maxims

David is my favorite podcast host and he repeats these maxims, that he learned from history’s greatest founders on a constant basis. We are lucky, that he wrote them down and I invite you to read them.

1. Excellence is the capacity to take pain. 2. Actions express priority. 3. Bad boys move in silence. 4. Belief comes before ability. 5. The public praises people for what they practice in private. 6. There are ideas worth billions in a $30 history book. 7. Successful people listen. Those that don’t listen, don’t last long. 8. Don’t do anything that someone else can do. 9. If you know your business from A to Z there is no problem you can’t solve. 10. Business *is* problems. The best companies are just effective problem solving machines. 11. Relationships run the world. 12. Mute the world and then build your own. 13. Gentlemen, watch your costs. 14. You aren't advertising to a standing army; you’re advertising to a moving parade. 15. Self pity has no utility. 16. Always more audacity. 17. Wisdom is prevention. 18. Go for great. (Munger) 19. Go for freedom. (Zell) 20. Making mistakes is the privilege of the active. 21. Time carries most of the weight. 22. Incentives rule everything around you. 23. Childhood does not allow itself to be reconquered. 24. Find a simple idea and take it seriously. 25. Good ideas are rare. When you find one bet heavily. 26. Genius lies in ignoring the unimportant. 27. Intensity is the price of excellence. 28. You can’t save souls in an empty church. 29. Scale and fanaticism combined is very powerful. 30. If you’re not working on your best idea you're doing it wrong. 31. Ease isn’t the goal; excellence is. 32. Become friends with the eminent dead. 33. People are power law and the best ones change everything. 34. By endurance we conquer. 35. Genius has the fewest moving parts. 36. Keep things simple and remember what you set out to do. 37. The founder is the guardian of the company’s soul. 38. In business the winning system goes almost ridiculously far in maximizing and or minimizing one or a few variables. 39. Imitation precedes creation. 40. Focus is saying no. 41. Optimism is a moral duty. 42. Intense concentration for hour after hour can bring out in people resources they didn’t know they had. 43. If anything is worth doing, it's worth doing to excess. 44. Obsess over customers. 45. Being at the extreme in your craft is very important in the age of leverage. 46. Learning is not memorizing information. Learning is changing behavior. 47. Whatever you do, you must do it with gusto, you must do it in volume. It is a case of repeat, repeat, repeat. 48. If you love what you do the only exit strategy is death.

Brick by brick

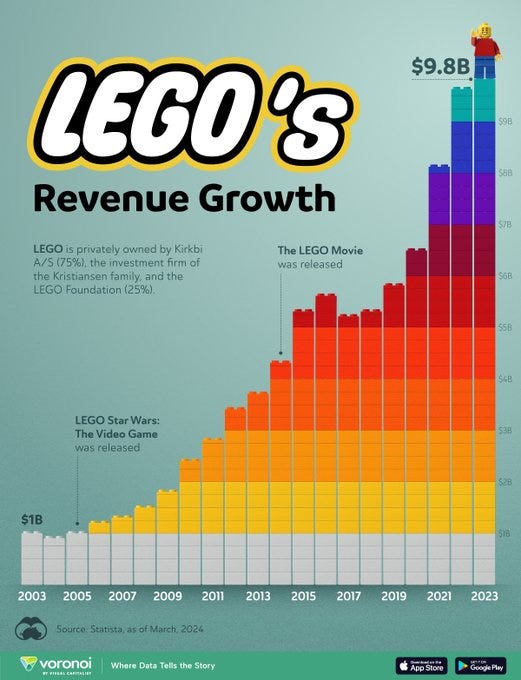

I am sure you know Lego. Especially if you grew up in Europe, there is a high chance that you used to play with Lego as a kid or that you are now collecting their nice models as an adult. In 2003 Lego was facing bankruptcy and pulled off one of the biggest comebacks of all time.

Who is your postman?

Everything below this line is only for you, my dear paid subscriber. Thank you for your support!

Keep reading with a 7-day free trial

Subscribe to 41investments’s Substack to keep reading this post and get 7 days of free access to the full post archives.