Weekly Notes #10

YTD performance, Lithium, living on a cloud, first principles and a crocodile eating Finland

I hope you are having a fantastic week and you are looking forward to learning something!

In case you want to re-read the previous weekly notes, here is the link

Without further ado, let’s start:

YTD Performance

Let’s start with this one: Buy great companies and ignore all the outside noise. That is the best approach to investing and also probably to life itself.

The general markets have had an incredible performance since the start of the year. Almost all large stocks are up double digits and the S&P500 is on pace for one of its best years. The previous years were also nothing short of astounding with 2021 +27%, 2022 -19%, and 2023 +24%. So much for low-volatility index investing.

After these high returns, humans tend to extrapolate past returns into the future. I would be careful about that and I would expect some years with lower returns ahead of us. The PE ratio of the index is at the highest value in the last 10 years (if you exclude the Covid year). Reversion to the mean will come in one form (fast-rising earnings of the companies) or another (falling share prices). Expect to see more of the latter.

Demand for Lithium and its effect on the price

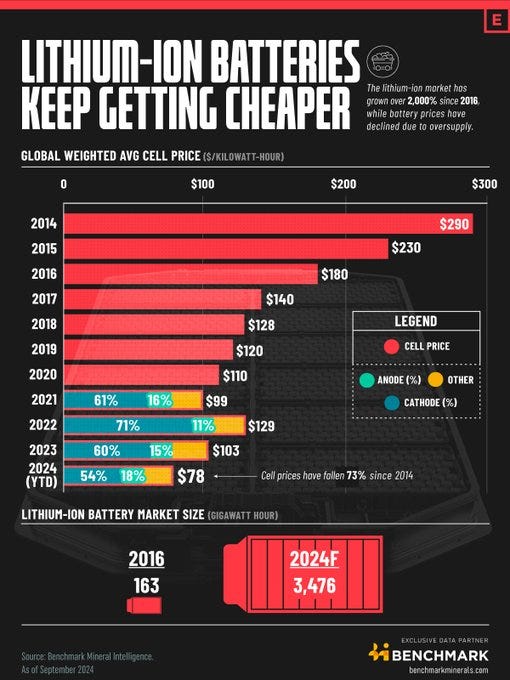

Batteries are the most expensive component in EVs. If you want to make them more affordable, we need to get batteries cheaper. Luckily this is exactly what is happening. The average price per kWh fell by 73% since 2014. Expect further progress on this front and you will see a) cheaper EVs and b) EVs with longer ranges, which can finally compete with traditional cars. The limited range, especially in colder conditions, is one of the main reasons why people still prefer petrol over electricity.

This very trend is also one of the reasons why I don’t like to invest in commodities. The cure for high prices is usually high prices itself. It brings new competitors into the market, makes the search for new sources more interesting (see fracking for oil), and also fuels technology advantage. This technological advantage comes in two forms: One is the optimization of the current material and the other is the search for alternatives. All taken together keep the prices of minerals flat or declining in the long run.

Looking at the growth of EV sales could lead to the conclusion that the underlying material for Lithium batteries must be in high demand and therefore drive up the price of this very commodity.

That is partially correct. There was indeed a price surge between 2021 and 2023, but today the price of Lithium is roughly where it was in 2016. How many people would have guessed this? Coming back: The cure for high prices is usually high prices.

Since I touched upon oil fracking beforehand: If you want to invest in one of the purest plays in the Permian Basin, which is the booming fracking region in the US, then check out my deep dive on Texas Pacific Land

Living on a cloud

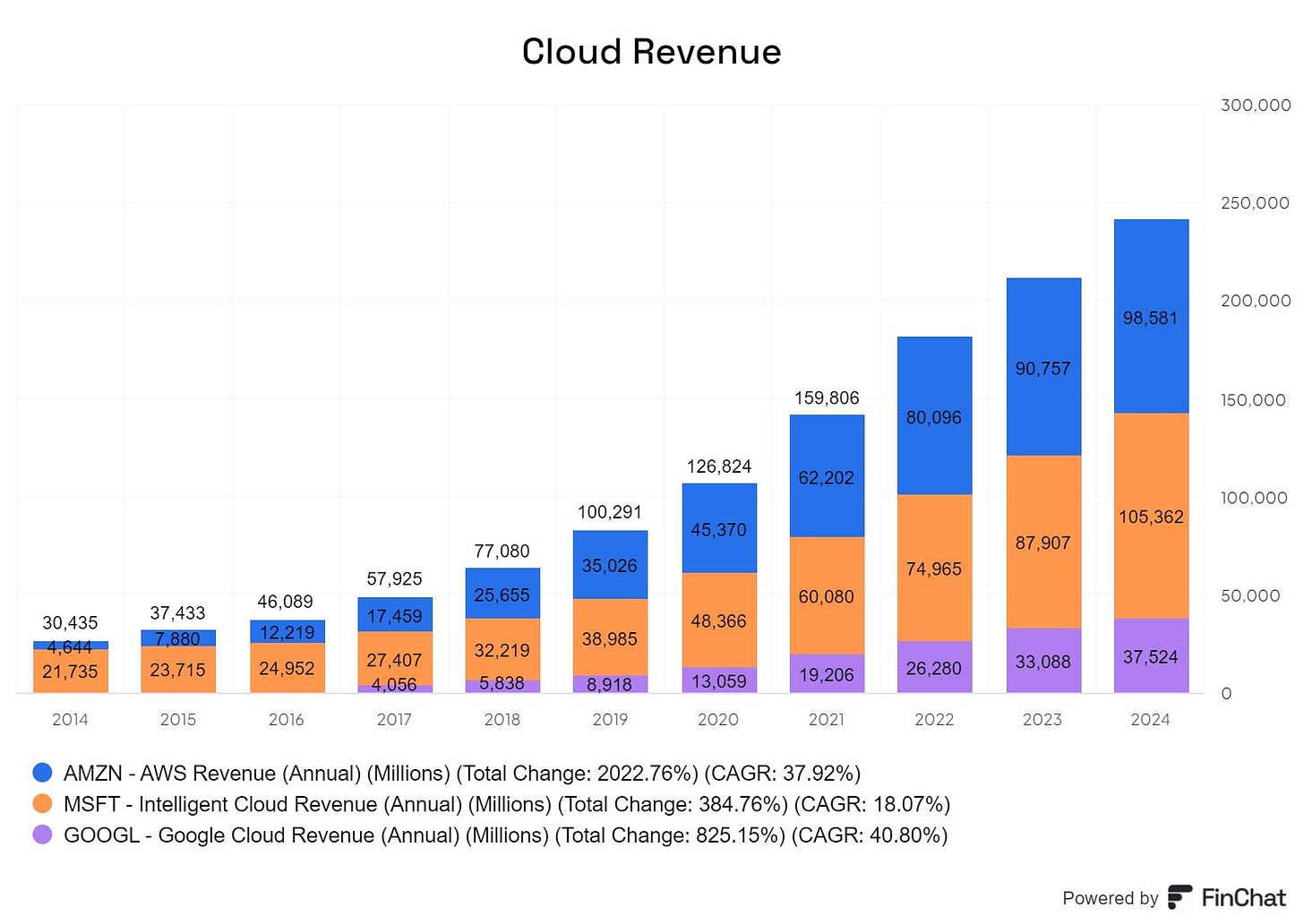

Microsoft, Amazon, and Alphabet have shown tremendous growth in their cloud segments. It is crazy to think about how small the revenue in this segment was just 10 years ago and how much money these three companies are now generating with their cloud segments.

AI and the continued need for computing power will drive this trend further and in turn make me a happy shareholder of these companies.

Invest in capital-light businesses

If you want to read the full article and learn about the management, the composition of the segments, takeovers, risks, fundamental analysis, and a conclusion please subscribe and support my work. To all existing subscribers: Thank you for your support and enjoy the rest of the article!

Keep reading with a 7-day free trial

Subscribe to 41investments’s Substack to keep reading this post and get 7 days of free access to the full post archives.