Weekly Notes #9

ASML, IPOs, finding a partner and making money by doing so as well as catching a rocket.

I hope you are having a fantastic week and you are looking forward to learning something!

In case you want to re-read the previous weekly notes, here is the link

If you like what you read and want to support my work, it would be amazing if you upgrade your subscription to a paid one

Without further ado, let’s start:

On ASML

ASML shares were beaten down based on a lowered forecast for 2025. As usual, price drives the narrative and ASML went from everybody’s darling to an over-hyped European company, and as we all know, Europeans are not good at high tech anyway. Therefore the company is trash. This has been the mood you get when you check Twitter/X in the last few days.

As a reminder: The stock came down hard from the ATH (-35%), but is now just flat (+/-0%) since the beginning of the year.

In the graph below you can see how ASML’s bookings (that is order intake) and sales (revenue) have been developing by quarter. There was a massive increase in backlog as long as the blue bars were larger than the orange bars. In the last quarter,s the trend reversed and as the revenue grew, orders were more reserved. One of the reasons for this huge order intake in 2021/2022 was the ongoing chip shortage back then. Now ASML is working on the order backlog and is recognizing the revenue. The very low bookings in Q3/2024 are one of the reasons why investors were scared. The main reason is ongoing struggles by two of their largest customers. Intel and Samsung are not doing that well right now, while TSMC is just running circles around the competition.

Imagine now, that instead of the spike in bookings in 2021/2022, the blue line would be averaged out over the quarters.

The chart looks completely different, doesn’t it?! We would not be having many of the discussions we have now about the quality of the company and instead, the narrative would be: Oh look, the company is having amazing revenue growth and oh my god this company is fantastic. As I wrote before, the stock price drives the narrative.

You are looking at the only company in the world that can build the newest semi-con machines. Without ASML we would not have 5nm or even next-gen 3nm. High-NA will eventually be adopted by all major fabs. Thanks to the most recent price drop, you can now buy ASML at a P/E of 38 with EPS growth in the high teens to 20s for the next years. If you don’t own ASML yet, this could be your chance to start a position.

Adobe & Texas Pacific Land Q2/2024 earnings

I have added my take on Adobe (encouraging) and Texas Pacific Land’s (very encouraging) Q2 earnings in my earnings post.

You can find the earnings summary here:

Investing in IPOs

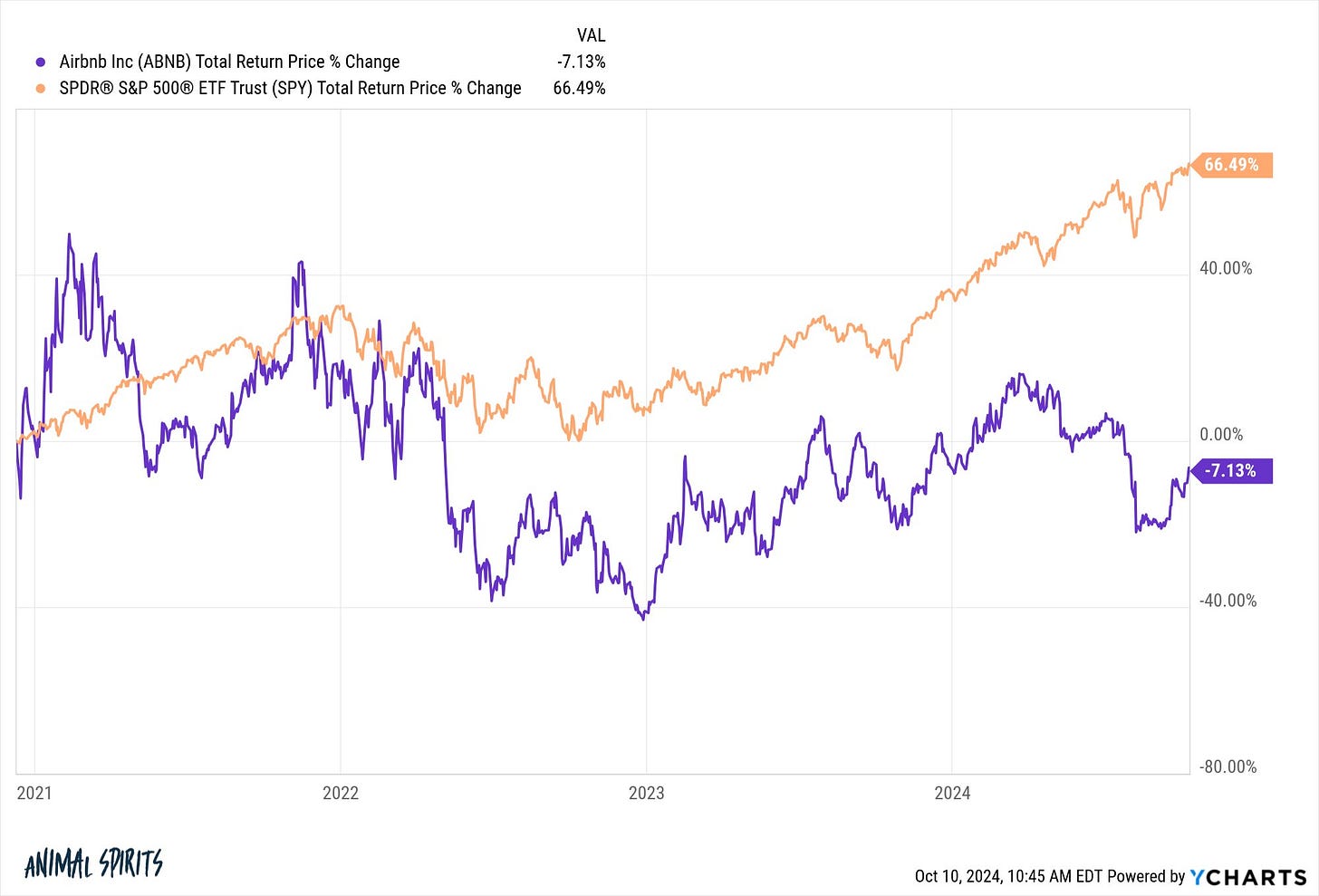

A general rule of thumb: Do not invest in IPOs (the first time a company goes public). The bride is the prettiest right before it is being sold. One more example of this is Airbnb. By itself a good company but the valuation at the time of the IPO was just too high. As a result, Airbnb shares have heavily underperformed the broad market since it is a public company.

There are many more examples. Just wait it out and buy the companies, once they have established a track record.

Nick Sleep and Qais Zakaria

This is an excerpt of the Founders podcast on Nick Sleep and Qais Zakaria. Together they are one of the best-kept secrets in the investing world. Their fund called Nomad was one of the best-performing funds in the last two decades and they undertook a similar investment life story as I did. First, you are looking for cheap companies that you can buy for cents on the dollar until you eventually realize that the best thing to do is just to buy great companies and hold them forever.

Both took asset concentration to the extreme when Amazon was at one point 70% of their portfolio and at the very end, they only held 3 stocks. These 3 stocks were Amazon, Berkshire Hathaway, and Costco. I am not there yet, but I also started to concentrate my portfolio into fewer positions with a larger exposure.

Their story is going to reflect just like Buffett and just like Li Lu. Eventually, all three of them or all four of them are going to come around to Charlie Munger's point of view on this. But at the very beginning, they start to find things that they can buy at one quarter, the replacement cost of the assets. They're buying assets in Thailand and United States and Zimbabwe. These are not great businesses. They're just fantastically cheap.

And then within a few years of doing this, they realize, oh, this strategy doesn't scale. It's exactly what Munger figured out. This strategy had a big drawback. When stocks like these rebounded and were no longer cheap, you had to sell them and then hunt for new bargains. And so they come around to Charlie Munger, the architect's point of view.

Remember, Buffett called Munger the architect of Berkshire and obvious solution to this was to buy and hold higher quality businesses that were most likely to continue compounding for many years. This grew out of a costly mistake.

You can find the podcast here: https://joincolossus.com/episode/364-nick-zaks-excellent-adventure-how-nick-sleep-and-qais-zaharia-built-their-investment-partnership/

How to find a partner

If you want to read the full article and learn about the management, the composition of the segments, takeovers, risks, fundamental analysis, and a conclusion please subscribe and support my work. To all existing subscribers: Thank you for your support and enjoy the rest of the article!