The difference between a good and a great company: part 2

Companies that I removed from the great list

Intro

This is the follow-up to the first post in this series. In Part 1, I laid the groundwork on how I evaluate companies and that a great company is not based on price but on the fundamentals of the company. Find the first post here:

While the discussed companies in Part 1 are still on my watchlist, there are some companies that I removed from my watchlist altogether. That means that I will not even invest in them if they become very cheap, because they don’t reach the threshold that I place on companies for my portfolio.

Today, we will have a look at these companies and why I no longer track them in detail. I believe that shortening the list of companies that you follow (more) closely will help you to better focus on the few really outstanding companies. Keep an open mind, but make sure that only the best companies pass your high threshold. If you changed your mind on some companies in recent months, let me know in the comment section below.

Cancom

Starting with a German IT company. Cancom brings the right prerequisites to be a great company. A German player in the field of IT services based in Munich. Based on the strong track record of both fundamentals and the stock price, I started following Cancom in 2019. I bought shares both in 2022 and 2023 after the large drop, but got increasingly uncomfortable holding the position in the long run and closed it (after waiting already too long) in early 2024 at a modest gain.

There are many reasons for the bad performance of Cancom and the fundamentals tell you quite a bit:

The topline grew at a reasonable rate with a dip in the first Covid year, 2020. The gross margins improved significantly, which is great. But here comes the bad news: The operating expenses and especially the selling, general & admin expenses (SG&A) grew faster than the gross profit. As a result, the increase in gross profit was more than compensated by the increase in operating expenses. Due to this fact, Cancom managed to post a higher operating income with €1 billion in revenue in 2016 than in 2022 with €1.3billion in revenue. Operating margins dropped from an already low 5% to just 2.5% in 2024.

Cancom will face issues with the struggling German economy, and sooner or later, the orders received will show this development.

What troubled me was the guidance given by the management. With the release of the Q2/2024 numbers on the 13th of August 2024, the annual guidance was reaffirmed. By then, the Cancom management already had half of Q3 in the rearview mirror. With the release of the Q3/2024 numbers on the 11th of November 2024, the management suddenly issued a profit warning and cut the expected EBITA from €87 million at the midpoint to €65 million at the midpoint.

All of this came after the large share buyback for 33€ a share in July 2024 (today the stock is trading for 26€ a share). This is just shortsighted and bad management, and enough for me to stop following the company and rather focus on fantastic companies. You will find some of these companies here:

Malibu Boats

A fantastic name for a company that makes fantastic, fun vehicles. As the name indicates, Malibu Boats builds boats. And not just any boats. Malibu Boats is the world's largest manufacturer of watersports towboats, with more than one-third of the global market share.

Malibu Boats showed a tremendous revenue development over many years, and with the onset of COVID, revenue exploded. While this itself is not a bad thing at all, the hangover came in 2023. As was the case with many recreational vehicle builders, such as RVs and campervans, the demand during Covid was not a constant increase in demand but rather a pull-in effect of future demand.

Many companies forecasted this revenue growth many years into the future and therefore either did large takeovers or increased their production facilities to serve future demand. While this makes sense in a growing market, it hurts once the market starts to go back to its more traditional growth trajectory.

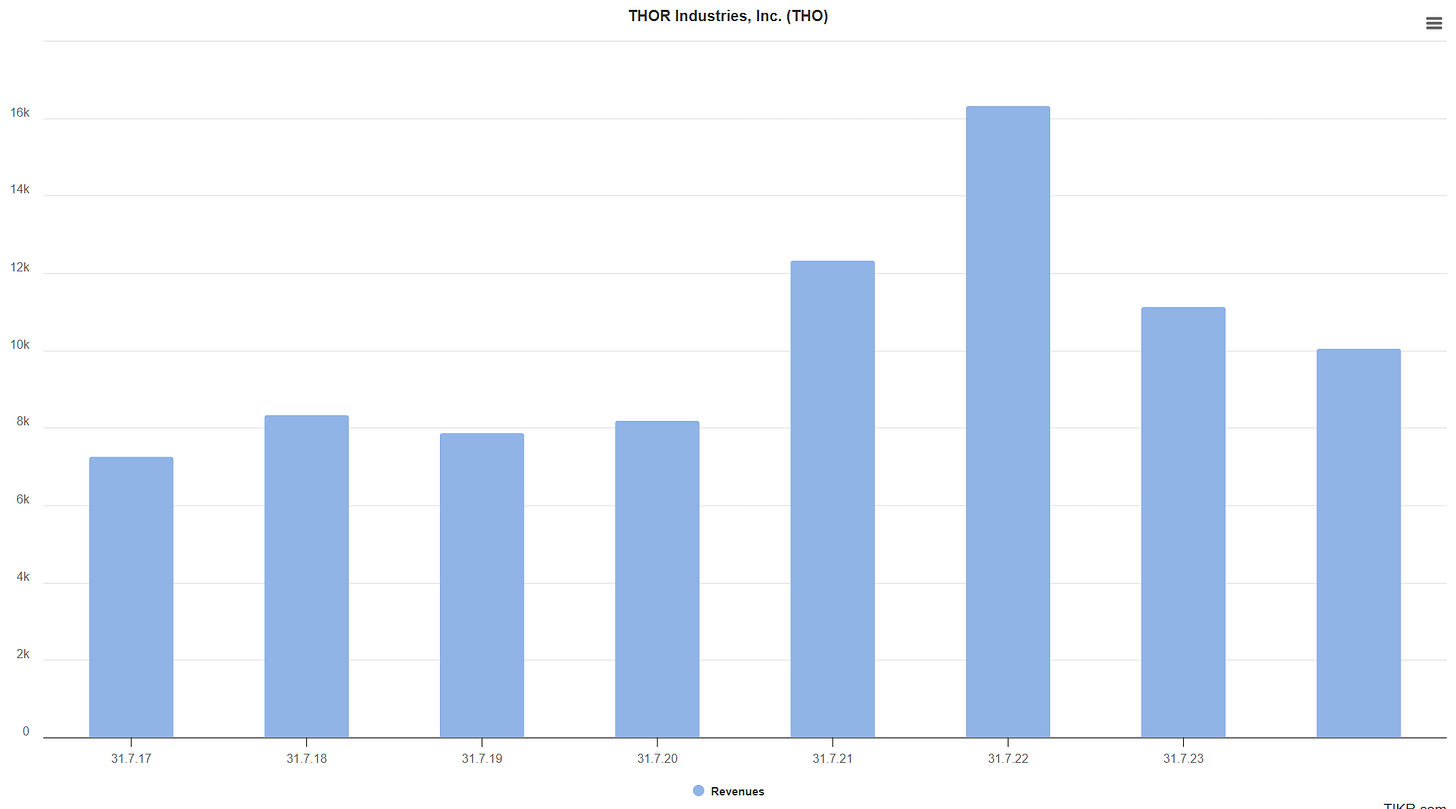

Another company that shows the very same pattern is Thor, the world’s largest manufacturer of recreational vehicles. Boom and bust. In Thor’s case, the COVID-19 boom jumpstarted a very flat revenue growth to unseen heights.

Once the pandemic was contained and the lockdowns lifted, a lot of people started to go back to their normal (vacation) habits and realized that they don’t need that RV or the (Malibu) boat, and sold theirs. This sudden large second market supply depressed prices for used vehicles and put enormous pressure on the manufacturers of said vehicles. Why buy a new one if you can get enormous discounts on second-hand purchases?

To make matters even worse, the elevated inventory levels at dealers just dragged out the whole development. Eventually, dealers will need to offer large discounts to get inventories back to a reasonable level. As long as the inventory at dealers is too high, these dealers will not get more boats/RVs from the manufacturers.

Since you are a dear reader of my Substack, you know one of my favorite sayings:

“price follows earnings”

Therefore, it is not a surprise to you when you see the stock price chart of Malibu Boats, and why I stopped following Malibu Boats in recent years.

Union Pacific

Moving from boats and RVs to trains: Even though the chart of Union Pacific looks like the stuff dreams are made of (at least until 2022), I decided to no longer follow Union Pacific in 2023.

The company has a fantastic moat in the sense that you will not have any competitors just starting with a new railway. The market is saturated, and a handful of companies control the freight train segment in North America. You can’t just start a new railway:

If you want to learn why I changed my mind on Union Pacific, please subscribe to support my work. To all existing subscribers: Thank you for your support! :)

Keep reading with a 7-day free trial

Subscribe to 41investments’s Substack to keep reading this post and get 7 days of free access to the full post archives.