Q3/2024 Superinvestor Portfolio Update

Lets dive into those lovely 13F Filings

Intro

The SEC requires funds with at least $100m assets under management to publish their holdings 45 days after the end of the quarter. This is a great source for us to see what the truly great investors are holding.

The important thing is to check the portfolios of investors who are as like-minded as you are. For me, these investors and funds include (among others) Chuck Akre, AltaRock Partners, Terry Smith, Li Lu, Valley Forge, Polen Capita,l and David Tepper. All of these investors tend to hold great companies for a long time and if they add to a completely new position then it is always worth taking a deeper look.

Some investors like Michael Burry have such a large turnover in their portfolios, that it may well be, that the investments you see in their most recent 13F filings are no longer part of their portfolio. Therefore the value of this information is very short-lived and may be outdated.

You will find a snapshot of the current portfolio of those fund managers who I follow closely below with my comments on the changes in their holdings. At the end of the article, you will find a summary of the changes and patterns which emerged.

Enjoy!

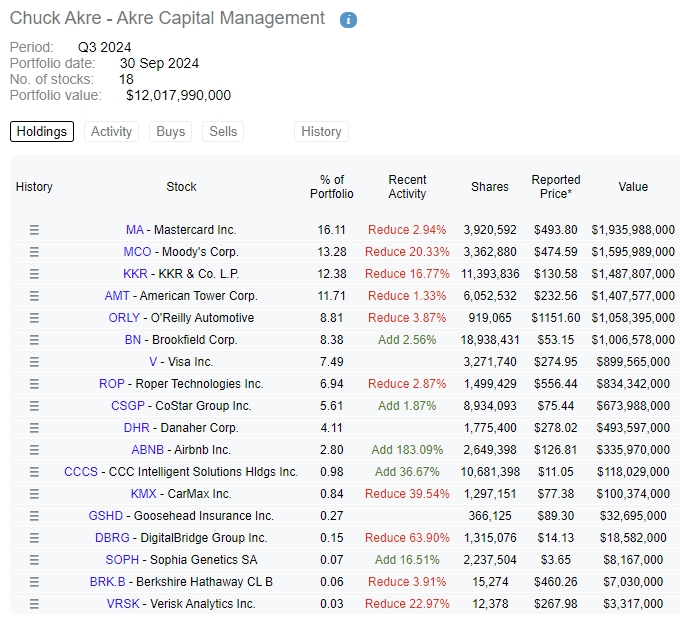

Chuck Akre - Akre Capital Management

Chuck Akre trimmed his top positions and sold his complete SBA Communication position. The largest addition was to Airbnb, a position he initiated in the previous quarter.

AltaRock Partners

A large increase in Amazon, which makes it the second largest position. The reduction in Visa shares was made up of a similar-sized increase in MasterCard shares. Both companies are similar and outstanding and operate in the very same segment.

This portfolio is made up entirely of outstanding companies.

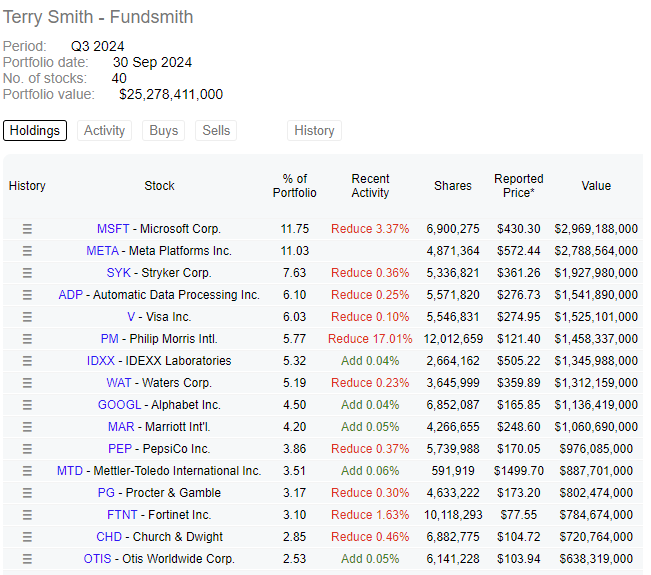

Terry Smith - Fundsmith

Terry Smith has a broadly diversified portfolio and is not as concentrated as Alta Rock Partners or Valleyforge. Due to this fact, there are a lot of small changes. The biggest change is an 82% reduction in McCormick (after they already sold sizable shares in Q2) and a 17% reduction in Philipp Morris. The other changes are all below 0.5% of the portfolio.

The top positions of the portfolio stay the same.

Valley Forge Capital Management

Valley Forge is as concentrated as they come. The partial sale of Fair Isaac was used to slightly increase the position in S&P Global and Moody’s. Most interesting for me is the doubling of the ASML shares.

I really like ASML and also included it in my best buys list for October. You can find the reasons here:

If you want to read the full article and learn about the management, the composition of the segments, takeovers, risks, fundamental analysis, and a conclusion please subscribe and support my work. To all existing subscribers: Thank you for your support and enjoy the rest of the article!

Keep reading with a 7-day free trial

Subscribe to 41investments’s Substack to keep reading this post and get 7 days of free access to the full post archives.