Best Buys October 2024

Two A-rated companies and some cleaning up

In this short format, I want to present to you companies and stocks, which are currently valued at an attractive level. Writing a deep dive takes me many hours and with this format,t I can introduce you to interesting ideas as of today.

I will only recommend high-quality businesses and I am not interested in cheap, but mediocre companies. Always keep in mind, that the quality of the company is the first filter. If it does not possess a very good business model, I am not interested in the company, even if it is dirt cheap. With that being said, let’s start!

Both companies presented today are among the largest holdings in my portfolio and I have added to both in the last weeks.

Alphabet

Investing doesn’t have to be hard. I bet all of you know and have used Google for the last 15+ years. Compared to that, most people kept searching for the next star instead of just buying Alphabet. Consider me one of these investors, before I finally saw the light and bought Alphabet shares in 2018 as a long-term holding and not just as a trading position.

To google has become a synonym for searching for information online. Now add YouTube, Google Maps, etc and you will find my apps which you can’t imagine living without. That’s a great fundamental for a company.

Where it gets interesting is the fact, that the stock of Alphabet, the holding company of Google has not been doing that well in comparison with the S&P500 in the last year.

The US Justice Department is pondering a breakup of Alphabet and this has put pressure on the stock. I would not worry too much, since a) such a breakup would take many years and b) the individual parts of Google might be worth more than the sum.

Alphabet’s self-driving subsidiary Waymo is doing extraordinarily well and also Google Cloud started to bring in a large surplus.

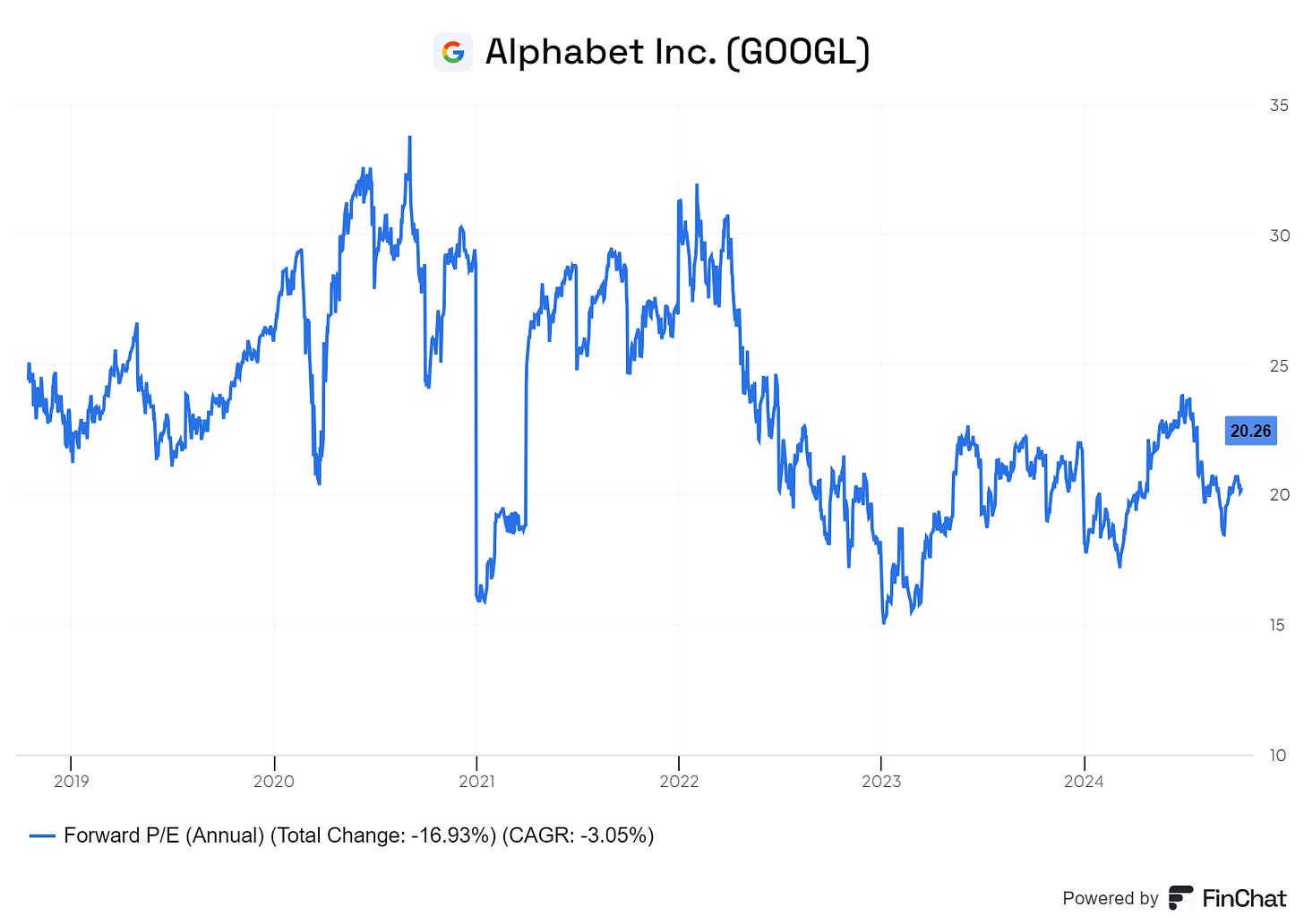

Considering the strength of the business and the moat of the company the valuation is very cheap. Alphabet is currently trading at an EV/net income of 22 and forward P/E of just 19. I am aware that an EV/(FCF-SBC) of 50 Alphabet does not look cheap. The current high spending on capex (most of it is AI-related) has a huge toll on the FCF. I believe, however, that this spending will increase the moat of Alphabet even further.

On a forward P/E level Alphabet is fairly cheap.

I believe in a couple of months a lot of investors will look back and will be surprised, that they missed buying Alphabet at such a great price.

ASML

If you want to read the full article and learn about the management, the composition of the segments, takeovers, risks, fundamental analysis, and a conclusion please subscribe and support my work. To all existing subscribers: Thank you for your support and enjoy the rest of the article!

Keep reading with a 7-day free trial

Subscribe to 41investments’s Substack to keep reading this post and get 7 days of free access to the full post archives.