Axcelis Stock Analysis Deep Dive

A fascinating small niche player in the semiconductor realm

Intro

As a tech-savvy investor, I am always searching for interesting opportunities and sectors that are destined to grow. Reading “Chip War” by Chris Miller only further drove the urge to have more exposure to the whole semiconductor value chain. If you haven’t read the book, I highly recommend it. ASML is one of the largest positions in my portfolio and now it’s time to take a deep dive into another interesting company, which is operating in a niche of the whole semiconductor manufacturing.

The Company

Axcelis describes itself like this:

“At Axcelis, we have a single goal: to help semiconductor manufacturers achieve the highest quality and yield, with the lowest cost of ownership. We deliver on that goal with ion implant platforms based on unique enabling technologies that provide unmatched purity, precision and productivity. The result: competitive advantage for our customers—and rapid growth for Axcelis.”

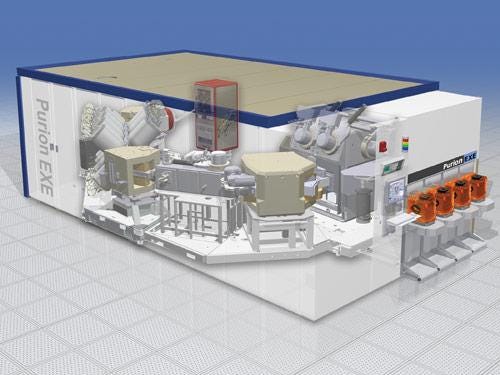

Axcelis designs, manufactures, and services ion implantation and other processing equipment used in the fabrication of semiconductor chips. Ion implantation makes up 98% of all revenues and is sold to chip manufacturers. A single machine costs between 2.6m and 12m USD. Apart from selling their Purion family of products, further revenue is generated by aftermarket products and services such as spare parts, tools, and maintenance services. The company was founded in 1978 and is based in Beverly, Massachusetts.

Axcelis has more than 3200 machines in use worldwide across 28 different countries. Most of the business is done abroad since most fabs are based in Asia. In 2023, 84% of all revenue was generated internationally (Asia making up 74%), while 94% of all sales were denominated in USD. Therefore the change in currency valuation is not critical for Axcelis. No customer contributes more than 10% of the Axcelis’ revenue and the revenue share of the top 10 customers has fallen from 70% in 2021 to 52% in 2023.

Production is done at the headquarters in Beverly as well as in South Korea. Axcelis employs a total of 1620 employees.

Writing a deep dive takes me 40+ hours to get a proper understanding of the company and the attributes of the industry it is working in. You will support me a great deal if you a) subscribe to this substack and b) recommend this blog to your friends and family. To all existing subscribers: Thank you for your support! :)

The Industry

The chip industry has been booming for years and the COVID supply chain disruptions made also the broad public aware, of just how important chips are. Trends such as digitization, IoT, 5G, and AI are more than buzzwords and have real business implications.

Creating the most advanced chips is a complex process. More than 300 process steps utilizing over 50 different types of process tools are needed to create a single device like a microprocessor. The fabs (fabrication facilities) are ever-growing in both size and quantity and are continuously working on increased efficiency.

If you want to learn the very basics of how a chip is being produced check out this video.

To see how the action is performed in real life, I recommend watching the following video:

Traditionally, the chip industry has been highly cyclical with huge profits in heights and bad losses in downturns. As a reference, see the large swings in the net income of Micron, one of the leading memory chip manufacturers.

McKinsey estimates the global semiconductor market to grow with a CAGR of 7% until 2030 with most of the growth coming from computing and wireless communication.

The Business

Since 98% of Axcelis’ revenue is coming from the ion implantation business, we first need to understand what exactly that is. Axcelis itself describes it as follows (If you want a simplified explanation, then skip this paragraph)

Ion implantation is a principal step in the transistor formation cycle of the semiconductor chip manufacturing process. Ion implantation is also used to change the material characteristics of the silicon or silicon carbide for reasons other than electrical doping, a process known as “material modification.” An ion implanter is a large, technically advanced system that injects dopants such as arsenic, boron or phosphorus into a wafer. These dopants are ionized and therefore have an electrical charge state. This electric charge state allows the dopants to be accelerated, focused and filtered with electric and magnetic fields. Ion implanters use these fields to create a beam of ions with a precisely defined energy level (ranging between several hundred and eight million electron-volts) and with a precisely defined beam current level (ranging from microamps to milliamps). Certain areas of the silicon wafer are blocked off by a polymer material known as photoresist, which acts as a “stencil” to pattern devices so that the dopants will only enter the wafer where needed. Typical process flows require twenty implant steps, with the most advanced processes requiring substantially more steps. Each implant step is characterized by four key parameters: dopant type, dose (amount of dopant), energy (depth into the silicon) and tilt/twist (angle of wafer relative to the ion beam).

If you say now, well that’s quite complicated, I have good news for you: I asked ChatGPT to explain it to a 10-year-old:

“Alright! Imagine you have a toy spaceship, and you want to make it super strong so it can fly through anything without getting hurt. Ion implantation is like giving your spaceship a special power-up. Here's how it works: You have tiny, invisible things called ions, which are like magical particles. Scientists use these ions to make materials stronger. They shoot these ions into the material, like shooting lasers at your spaceship. When the ions go inside, they make the material tougher and better at doing its job. So, it's like your toy spaceship getting a special shield that makes it the coolest, strongest spaceship in the whole galaxy!”

Here is another great description that I have found: “Doping, or modifying, a semiconductor wafer is the process by which “impurities” are introduced into the wafer material to alter its electrical properties to form semiconductor devices like Diodes, discrete transistors, and integrated circuits. Ion implanters generate a steerable ion beam, formed from the desired source material, that implants the ions at the required depth and uniformity beneath the surface of the substrate.”

Doug Lawson, the head of corporate Marketing and Strategy shared the following thoughts on the importance of ion implantation: “ion implant, first of all, is the most critical process tool within a power device. It's the equivalent of what lithography is to advanced logic”

To get an idea of what the machines look like when they are in action, watch this video from Axcelis. To give you an idea of how little this company is covered by the public, check out the view count of the video. As of this writing, it had less than 500 views.

If you want to read the full article and learn about the management, the composition of the segments, takeovers, risks, fundamental analysis, and a conclusion please subscribe and support my work. To all existing subscribers: Thank you for your support and enjoy the rest of the article!

Keep reading with a 7-day free trial

Subscribe to 41investments’s Substack to keep reading this post and get 7 days of free access to the full post archives.