AMD Q4/2024 Earnings Review

Fantastic growth compared to 2023 but what about the guidance?

AMD released its Q4 earnings on the 4th of February. Let's dig in:

If you haven’t read my deep dive on AMD, I highly encourage you to do so, to learn more about the business and why I see great potential for AMD.

Management’s summary

That’s how the management described the results:

2024 was a transformative year for AMD as we delivered record annual revenue and strong earnings growth. Data Center segment annual revenue nearly doubled as EPYC processor adoption accelerated and we delivered more than $5 billion of AMD Instinct accelerator revenue. Looking into 2025, we see clear opportunities for continued growth based on the strength of our product portfolio and growing demand for high-performance and adaptive computing.”

“We closed 2024 with a strong fourth quarter, delivering record revenue up 24% year-over-year, and accelerated earnings expansion while investing aggressively in AI and innovation to position us for long-term growth and value creation.”

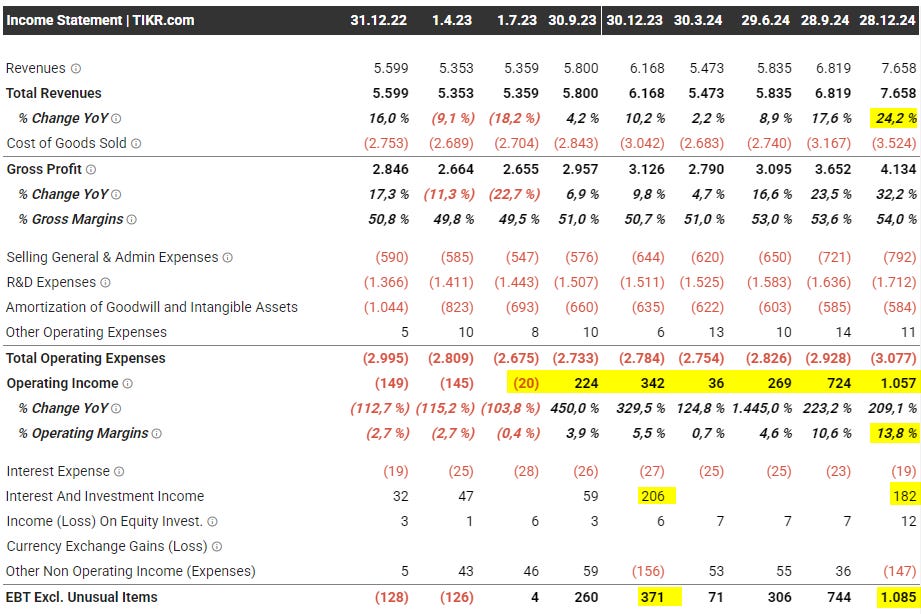

Income Statement

AMD posted a record fourth-quarter revenue of $7.7 billion with great gross margins of 54%. The revenue was up 24% compared to the previous year and as a result, the gross profit was 32% higher. The higher gross profit combined with increased (at a lower pace) operating expenses led to an operating income of $1 billion. That is almost three times as much as the operating income of Q4/2023 and shows you the power of the increased revenue.

Interest and investment income was slightly lower than last year due to falling yields.

Merger and restructuring charges as well as income tax expenses (those were positive in Q4/2023) led to an overall lower net income compared to the previous year. I still like the progress on the operating income a lot. Operating income will dictate where the net income goes and any improvement here will lead generally to better net income. The outstanding shares increased by 0.4% year over year.

Balance Sheet

Cash and short-term investments decreased slightly and the inventory and prepaid expenses increased quite a bit due to the accelerating business. Goodwill is still very high due to the takeovers of the last years. long-term debt of $1.7 billion remains unchanged from the last quarters

Cash Flow Statement

My favorite part of every analysis. Earnings are easy to influence, cash is king, and a lot harder to fake than earnings. In AMD’s case, the large depreciation and amortization expenses impact the net income but since no actual cash left the company (only at the original purchase date) these are added back in and have a positive impact on the cash flow.

Stock-based compensation is down versus the previous year and I like that! Cash from operations is a lot stronger than last year

Capital expenditures increased at a reasonable level and as a result of the high operating cash flow, the free cash flow showed strong improvements year over year. AMD bought back shares for $298 million in the quarter but the number of outstanding shares increased nevertheless based on the higher stock-based compensation.

Overall, the fundamentals look good and it is time to go into the operational metrics.

Operational metrics

The very important (hello AI) data segment showed strong momentum and increased 69% in Q4 year over year to $3.9 billion in revenue. For the full year 2024, data center revenue increased 94% to $12.6 billion.

This graph illustrated nicely how important the growth in data center revenue and therefore operating income is for the overall performance of the company. The revenue almost doubled compared to last year! I believe with the rise of AI there is much more to come.

“Public cloud demand was also very strong with a number of EPYC instances increasing 27% in 2024 to more than 1,000. AWS, Alibaba, Google, Microsoft and Tencent launched more than 100 AMD general purpose and AI instances in the fourth quarter alone”

The acquisition of ZT Systems passed further milestones and the acquisition is expected to close within the first half year of 2025.

Product

If you want to read the full article and learn about product news, guidance, and my summary please subscribe and support my work. To all existing subscribers: Thank you for your support and enjoy the rest of the article!

Keep reading with a 7-day free trial

Subscribe to 41investments’s Substack to keep reading this post and get 7 days of free access to the full post archives.