I hope you are having a fantastic week and you are looking forward to learning something!

In case you want to re-read the previous weekly notes, here is the link

Without further ado, let’s start:

SBC and the effect on the stock price

There is a general connection between the amount of dilution of outstanding shares through SBC and the medium-term stock price. As I wrote in last week’s edition, I am not a fan (to say the least) of excessive SBC.

Talking about SBC: Snap might be one of the worst examples when it comes to SBC. The executive team is getting rich while the company does not earn any money. This is modern-day robbery.

Some thoughts on drones

I remember flying a drone for the first time about 10 years ago and it was quite some fun. Jumping ahead, drones have become a major tool in modern warfare as seen in Ukraine. It’s not just about reconnaissance but also suicide drones, which can eliminate a tank worth millions with a 500$ drone. As a side note: A Russian T90 costs between 2.5m to 3.5m and a German Leopard somewhere between 12-30m USD.

Then again technology can be also used for beautiful things like drone shows. Expect to see more of these in the future as a replacement or addition to fireworks.

Here is a video of shows made of 8000 (yes you read that correctly) drones:

https://x.com/41investments/status/1840828532974632972

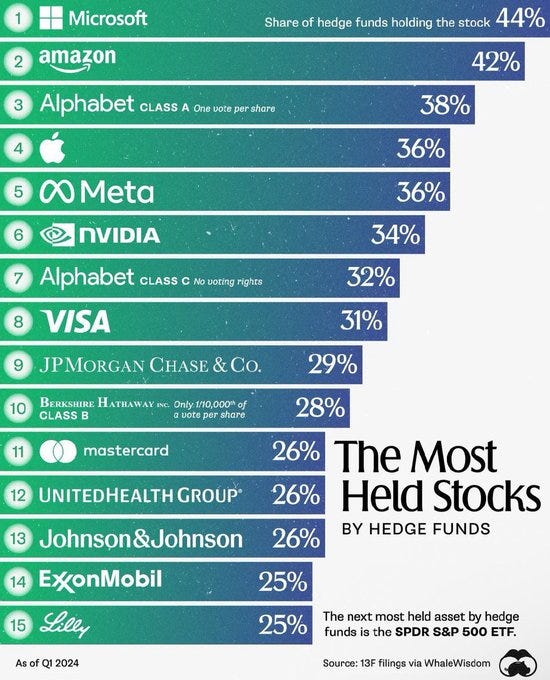

Hedge Funds are just copying ETFs

Most hedge funds charge you high fees and most of them tend to underperform the broad markets for that very reason. Interestingly the most common shares held by hedge funds are exactly those with the highest weighting in the S&P500/Nasdaq. To be fair most of these companies are also fantastic businesses.

While we are on the topic of funds: Cathie Woods is one of the most popular fund managers due to her performance during the Covid bubble. Gravity eventually did its work and a lot of the holdings she had turned out to be flukes. Berkshire on the other hand is walking to a steady beat. Apart from beating Cathie by a mile, the investors of Warren could also sleep tighter.

This is the modern story of the fable the tortoise and the hare.

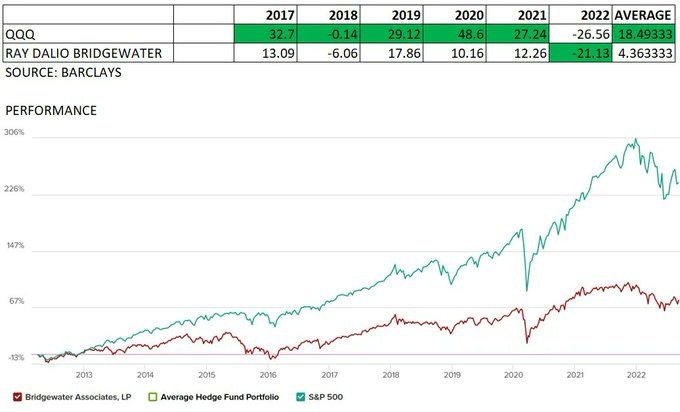

Ray Dalio’s hedge fund Bridgewater hasn’t been doing great either. One of the main reason are the high fees that the fund charges investors. Someone has to pay the 2000-man-strong team.

AI - yet again

The Accenture CEO shared some numbers on the accelerating AI bookings. As one of the prime consulting companies, this shows how much interest there is for AI in the industry.

“For the full fiscal year, we had $3B in new GenAI bookings, including $1B in Q4...The magnitude of this achievement is seen in the comparison to FY '23, where we had approximately $300Min sales and roughly $100M in revenue from GenAI”

I came across this nice picture explaining why Nvdia is doing so well. I would adjust it by putting a stand behind Nvidia which is owned by ASML and Taiwan Semiconductor. Without these two, Nvidia would not be able to sell any GPUs.

ASML is at the moment also valued at an attractive price when considering the expected growth. We are looking at an EV/net income of 21 in two years. I believe this is very attractive for the monopoly on modern chip manufacturing technology.

One more thing on AI: The Nobel Prize for physics was awarded to the researchers John Hopfield and Geoffrey Hinton "for foundational discoveries and inventions that enable machine learning with artificial neural networks."

How to get rich - and then lose it all

If you want to read the full article and learn about the management, the composition of the segments, takeovers, risks, fundamental analysis, and a conclusion please subscribe and support my work. To all existing subscribers: Thank you for your support and enjoy the rest of the article!

Keep reading with a 7-day free trial

Subscribe to 41investments’s Substack to keep reading this post and get 7 days of free access to the full post archives.