Paypal Q3/2024 Earnings Review

Still cheap but the lackluster outlook leaves a sour taste

PayPal released its Q3 earnings on the 29th of October. Let's dig in:

Management’s summary

That’s how PayPal describes its results:

“PayPal delivered strong financial and operating results during a highly productive third quarter. We are making solid progress in our transformation as we bring new innovations to market, forge important partnerships with leading commerce players, and drive awareness and engagement through new marketing campaigns. We are raising our full year non-GAAP guidance and are pleased with the strength we are seeing across the business. We’ve built a solid foundation in this last year that will serve us in the years to come.”

Income Statement

The growth in revenue is slowing down (bad), while the gross margins are increasing (good). Combined this leads to an increase in Gross Profit, which is partially offset by rising operating expenses and leads to a small increase in operating income. The interest income from funds held on behold of customers rose again to $183 million in the quarter, but at the same time, the interest that is paid on the company’s debt also rose.

Together we arrive at the effects from FX losses and losses on the sale of investments at a net income that is slightly below last year’s Q3. I was hoping to see better traction here.

Balance Sheet

Cash and short-term investments decreased to $11.9 billion and net debt (cash minus debt) was -$517 million. Other current liabilities (these are mostly funds held on behalf of customers) were mostly flat at $41.2 billion and have the lovely characteristic, that PayPal keeps the interest paid on those cash balances.

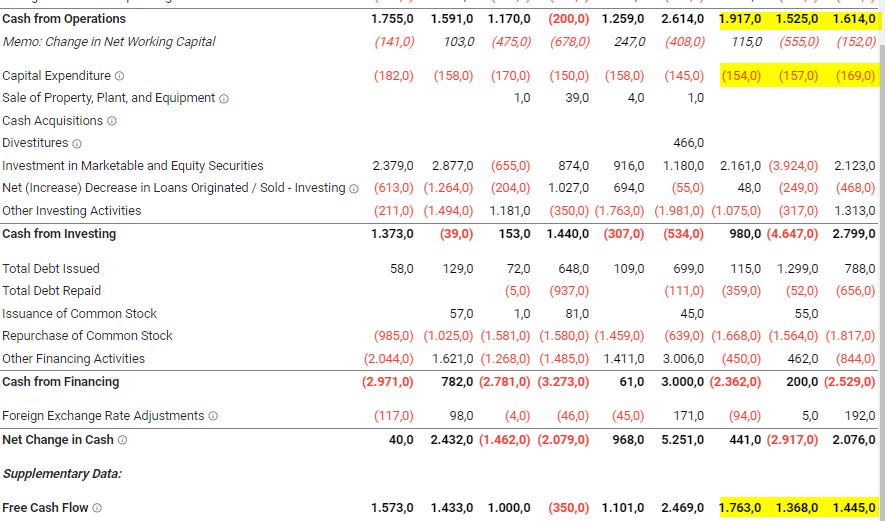

Cash Flow Statement

The effects from the originating and selling effect of the BNPL (buy now, pay later) portfolio largely occurred from Q2 2023 to Q4 2023. The amount of Stock-based compensation is declining (great news) and the operating cash flow has been ok. Keep in mind, that Q4 is always the strongest quarter of the year to do the shopping season for Christmas and Black Friday.

Capital expenditures are still quite high for a software company.

$1.8 billion in share buybacks in Q3 and a total of $5.4 billion in the last twelve months. That is huge! To be fair, these massive buybacks were partially offset by still high SBC, which was $1.3 billion in the last 12 months. Net buybacks of $4.1 billion were still quite something.

Operational metrics

If you want to read the full article and learn about the management, the composition of the segments, takeovers, risks, fundamental analysis, and a conclusion please subscribe and support my work. To all existing subscribers: Thank you for your support and enjoy the rest of the article!

Keep reading with a 7-day free trial

Subscribe to 41investments’s Substack to keep reading this post and get 7 days of free access to the full post archives.