Update October 2024:

I sold my very small position late in 2023 because I did not see any of the points improving that I mentioned below. There are so many better companies out there. For transparency reasons, I will keep this post in its original form online.

Intro

Germany notoriously lags behind in all kinds of digitization matters. Especially the government and public institutions are a far cry from those in the Nordic countries. At the same time, the requirements to keep up with digitization are continuously rising. This poses a challenge, especially for small and medium-sized companies which cannot afford a huge IT department. Enter players like Datagroup, Bechtle and Cancom. These companies help the private and public sector to get their systems and software to the status quo. Today I will focus on Datagroup as one of the smaller players in this field.

The Company

Datagroup is based in Pliezhausen, Baden-Württemberg in the south of Germany, and was founded in 1983 by Max H.-H. Schaber and Herbert Schwarzkopf. In 2006 Datagroup entered the stock market. The company has a broad footprint across Germany.

The company has 3500 employees, of which the majority is based in Germany, and focuses on companies with €100 to €5000m in annual revenue, as well as the public sector.

With a market cap of €419m it is a relatively small company.

The Business

Datagroup has two big server hubs: One in Düsseldorf and the other in Frankfurt in very close proximity to DECIX and ECIX which are two of the largest internet exchange points in the world. Due to its location, Datagroup is very well connected to public cloud services such as AWS, Azure, and SAP. Datagroup is ISO certified for IT Service, IT Security, and Quality management.

80% of Datagroup’s revenue comes from the service business, with the other 20% contributed by the trading business.

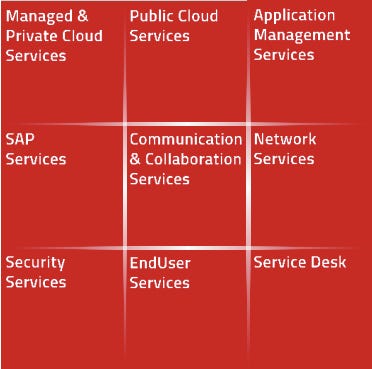

The heart of Datagroup is the “Corbox” (Corporate IT out of the box) which it also labels as IT as a service. The Corbox can be anything from a full-fetched outsourcing of the IT infrastructure for the customer to only individual modules such as SAP hosting or public cloud services.

Datagroup has a rich history of small takeovers. Since the IPO in 2006, Datagroup has acquired 30 companies and plans to acquire 2-3 companies per year in the future. Once a company has been acquired, Datagroup checks existing contracts and terminates those, that provide low margins and at the same time moves business to its multi-year length Corbox product. Due to this, the revenues provided by the new company tend to decrease in the first years, while the margins of the new business are higher than the terminated old contracts.

If you want to read the full article and learn about the management, the composition of the segments, takeovers, risks, fundamental analysis, and a conclusion please subscribe and support my work. To all existing subscribers: Thank you for your support and enjoy the rest of the article!

Keep reading with a 7-day free trial

Subscribe to 41investments’s Substack to keep reading this post and get 7 days of free access to the full post archives.