ASML Q4/2024 Earnings Review

Learn what one of the most important companies in the world was up to in Q4

ASML released its Q4 earnings on the 29th of January. While the earnings release was some days ago, I believe ASML is one of the most important earnings reports to analyze since ASML is at the very forefront of the semiconductor industry and a fantastic company.

Let's dig in:

Management’s summary

That’s how the management described the results:

"Our fourth-quarter was a record in terms of revenue, with total net sales coming in at €9.3 billion, and a gross margin of 51.7%, both above our guidance. This was primarily driven by additional upgrades. We also recognized revenue on two High NA EUV systems. We shipped a third High NA EUV system to a customer in the fourth quarter.

"ASML achieved another record year, ending with total net sales for 2024 of €28.3 billion, and a gross margin of 51.3%.

"Consistent with our view from the last quarter, the growth in artificial intelligence is the key driver for growth in our industry. It has created a shift in the market dynamics that is not benefiting all of our customers equally, which creates both opportunities and risks as reflected in our 2025 revenue range.”

Income Statement

The record high revenue of €9.3 billion (driven by the recognition of two high-NA systems and good installed base revenue at a very good gross margin of 51.7% (even though the gross margin was negatively impacted by the revenue recognition of the two high-NA systems) was the main driver for the good results. Operating expenses increased 8% compared to Q4/2023. The fast growth in gross profit, paired with slower-rising expenses, led to a supreme operating income of €3.4 billion.

A fairly high income tax ratio of 21.2% decreased the EBT to €2.7 billion in net income. This high tax rate was caused by a one-off historic tax position and should be lower in the quarters to come. Taxes are a necessary evil, and in the end, I am happy about the good net income.

ASML did not repurchase any shares in Q3 and Q4 of 2024, and as a result of the stock-based compensation and the repurchases in Q1 and Q2, the number of outstanding shares declined minimally from 393.8 to 393.6. The EPS increased from 5.2 in Q4/2023 to 6.8 in Q4/2024.

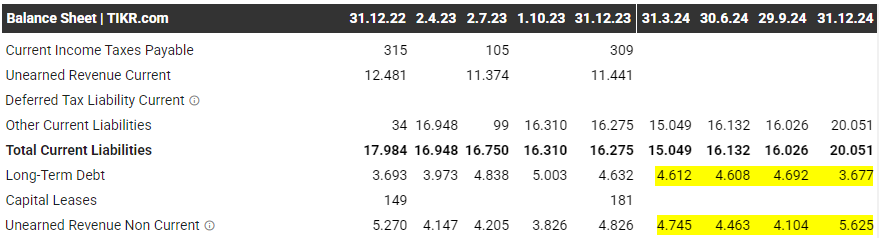

Balance Sheet

On the asset side of the balance sheet, ASML has tons of cash at €12.7 billion. The inventory stabilized at a high level in the last three quarters.

On the liability side, long-term debt decreased, and the unearned revenue noncurrent increased significantly.

Cash Flow Statement

The cash flow was mainly influenced by the change in other net operating assets. This was driven by the revenue recognition of two high-NA machines and downpayments made by customers.

Capital expenditures increased quite a bit compared to the previous quarters. ASML continues to pay dividends and aims to pay a total dividend of €6.40 for the year 2024. This implies a dividend ratio of 0.9%. This is not super high, but it's a nice gift every now and then to your bank account. With the growth opportunities of ASML, I am very happy to keep my money invested in ASML, and I don’t mind the low dividend ratio.

Operational metrics

Bookings came in very strong at €7.1 billion, split into €3 billion of EUV (the newest technology) and €4.1 billion in non-EUV. Logic made up 61% of the bookings, and memory contributed the remaining 39%.

The backlog is at a very healthy €36 billion, and what I like as well is the increasing revenue from the line “of which is service”.

If you want to read the full article and learn about operational metrics, product news, guidance, the current valuation and my summary, please subscribe and support my work. To all existing subscribers: Thank you for your support, and enjoy the rest of the article!

Keep reading with a 7-day free trial

Subscribe to 41investments’s Substack to keep reading this post and get 7 days of free access to the full post archives.