Amadeus FiRe Stock Analysis & Deep Dive

A misunderstood growing company with an EV/FCF of just 7.1

Update October 2024

I sold my small position in late August 2024 because I see better long-term opportunities in other companies. The company is hit harder than expected by the (most likely) coming recession in Germany and I believe that Amadeus Fire has some challenging years ahead. There are so many better companies out there. For transparency reasons, I will keep this post in its original form online.

Intro

While screening for interesting investment opportunities I came across Amadeus FiRe and it’s a surprisingly cheap multiple of an EV/FCF of 7.1. As a logical conclusion, I had to dig deeper to learn more about the company.

The Company

Amadeus FiRe is a Frankfurt, Germany-based company that was created through the merger of Amadeus and FiRe in 2003 and has about 4000 employees. Of these 4000 employees 2600 are placed at customers. The company benefits strongly from the “Fachkräftemangel” (shortage of skilled labor) which is a word in everyday German news. The company focuses on commercial/business and IT specialists. Amadeus FiRe is working exclusively in Germany and has 22 locations while working with more than 10.000 customers.

The Industry

The trend in Germany is clear: The lack of skilled labor is ever increasing and companies are willing to spend money on these rare specialists. Amadeus FiRe is also a main benefiter of the retraining and education program from the German government to retrain unemployed people in order to give them new employment opportunities.

The Business

Amadeus FiRe specializes in 4 categories: Temporary Employment (44% of the revenue), professional development (31%), recruitment (18%), and interim and project management (7%). In the case of interim and project management, Amadeus FiRe works as a broker between independent, self-employed people and companies.

Through the different business segments Amadeus FiRe has the goal to hire employees, turn these employees into students for their own educational training, and later on rely on them as customers for their hiring solution.

Writing a deep dive takes me 40+ hours to get a proper understanding of the company and the attributes of the industry it is working in. You will support me a great deal if you a) subscribe to this substack and b) recommend this blog to your friends and family. To all existing subscribers: Thank you for your support! :)

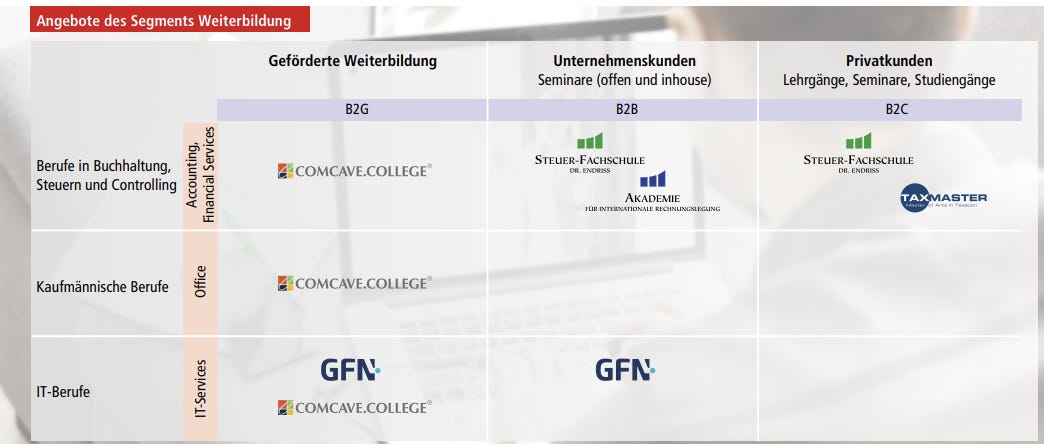

Professional development

In the segment of professional development, Amadeus FiRe offers solutions for private customers, companies, and state-supported education through its various brands. Interestingly the demand for state-supported education contrasts the demand of companies: In times of crisis, companies save and therefore have less demand, while the government has a larger pool of unemployed people who are getting trained. The gross margin for professional development is between 60 and 65% and therefore the highest margin segment of the company.

Temporary Employment

The high demand for skilled labor makes up for the fear of a recession and companies are still in desperate search. On top of that, Amadeus FiRe offers great flexibility for the customer of placing temporary workers. This enables the customer to increase their capacity without hiring these people and considering the strong German employment law having them on the payroll in the long run.

Increased costs in terms of salaries for temporary work placements are being passed on to the customer and have therefore no effect on the profitability of Amadeus FiRe. What has a large effect is the number of sick days, since Amadeus FiRe can’t bill these to the customer. The number of sick days in 2022 was extraordinarily high and cost the company €4.9m compared to the relatively low number of sick days in 2021. Despite the high number of sick days, Amadeus FiRe still reported a margin of 33% in the segment of temporary work placement.

In terms of employee satisfaction AmadeusFiRe scores very high on the platform Kununu. A score of 4.5 is very high, especially considering that AmadeusFiRe is placing the employees quite often at their clients.

The Management

The company is fully aware that it cannot reinvest all the generated cash flow and therefore is paying handsome dividends. The plan is to pay out 67% of the profit, which will give investors a very handsome payout.

CEO Robert von Wülfing holds 2400 shares worth €260k.

If you want to read the full article and learn about the management, the composition of the segments, takeovers, risks, fundamental analysis, and a conclusion please subscribe and support my work. To all existing subscribers: Thank you for your support and enjoy the rest of the article!

Keep reading with a 7-day free trial

Subscribe to 41investments’s Substack to keep reading this post and get 7 days of free access to the full post archives.