Adobe Stock Analysis & Deep Dive January 2025

Back at the same P/E as my last deep dive. Is it as attractive as in 2023?

I initially published my Adobe Deep Dive in May 2023 and I also pitched it at an investors meeting in Omaha in May 2023. The share price rallied after I presented the idea but has come down significantly since then. So it is time to update and extend my deep dive and to have a look if this is now a great buying opportunity. By adopting the structure of my most recent deep dives, this Adobe deep dive became a lot more detailed compared to the previous one.

Intro

I added Adobe to my portfolio from April to June of 2023. It was one of these companies that I followed for years and never found the right opportunity to buy shares. Most of the last years it was too expensive for my taste and I had to watch the increase in the share price from the sideline. Luckily for us, all shares eventually come down to a reasonable valuation and when they do, it’s time to buy them.

If you missed my deep dive into AMD, make sure to read it

The Company

Adobe is a US-based company headquartered in San Jose, California, and employs more than 30,000 people. Adobe was founded in 1982 and had its IPO in 1986 at a split-adjusted share price of just $0.17. I guess you would like to make a call to the past and tell your parents to buy some Adobe and hold onto it tightly.

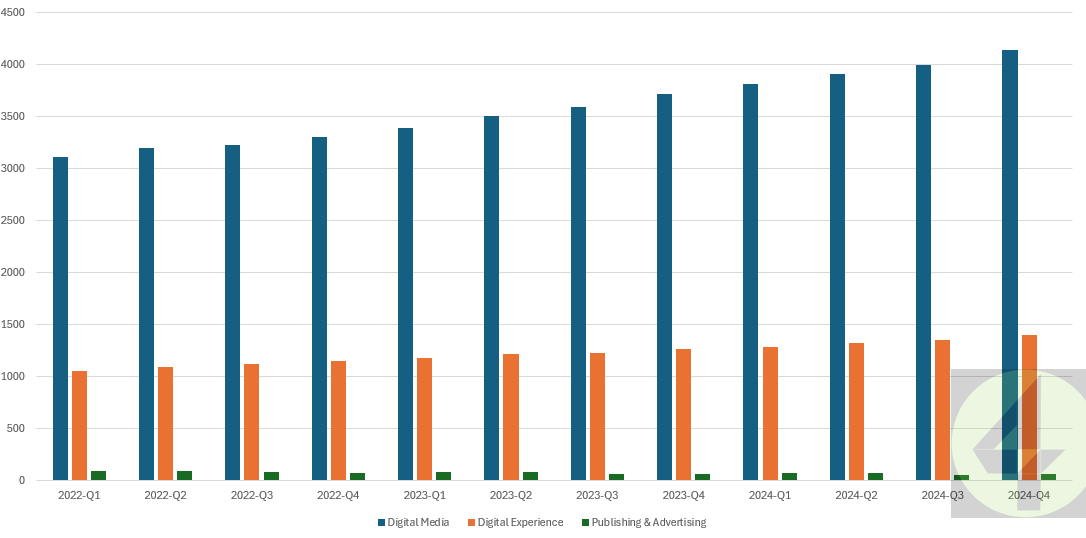

Adobe’s business is split into 3 different segments: Digital Media, Digital Experience, and Publishing &Advertising. Adobe changed its segments and now groups the Creative Cloud and Documents Cloud under the Digital Media segment.

Adobe Creative Cloud

I am sure most of you have heard of Photoshop, but Adobe Creative Cloud is home to many more products. Illustrator for icon design; the video editor Premiere Pro; InDesign for magazines, books, and PDF publishing to name a few. Here is an overview of all the applications that are grouped in the Creative Cloud.

Since switching to a subscription model, solutions like Photoshop have become much more affordable. Now users pay a monthly fee of 20$ compared to a couple of hundred dollars in the past.

This quote by ADobe’s CEO Shantanu Narayen summarizes the above image in a great way. Adobe is bringing together its different product categories and wants its customers to work seamlessly with the different products.

We're amplifying creativity and productivity by enabling the convergence of products like Photoshop, Express and Acrobat as knowledge workers and creatives seek to make content more compelling and engaging. We're bringing together content creation and production, workflow and collaboration and campaign activation and insights across Creative Cloud, Express and Experience Cloud.

Writing a deep dive takes me 40+ hours to get a proper understanding of the company and the attributes of the industry it is working in. You will support me a great deal if you a) subscribe to this substack and b) recommend this blog to your friends and family. To all existing subscribers: Thank you for your support! :)

Adobe Document Cloud

The document cloud focuses on all forms of creating, editing, signing, and workflows around PDFs. PDF became the gold standard for documents over the years and Adobe is by far the most used solution. Some people believed that the competitor and one trick pony for e-signatures Docusign was worth $61bn at the peak of the Corona bubble in 2021. That idea did not last that long when you have a look at its stock price today.

Here is an overview of the different apps within the Document Cloud and their capabilities.

I like the strategy that Adobe is following to convert free to paid users: Target them where they are most likely to interact with PDFs. This is what Daniel Durn, CFO of Adobe had to say in the Q3/2024 call:

Q3 Document Cloud growth drivers included: Usage and MAU growth across Adobe Reader and Acrobat; usage and MAU growth via third-party ecosystems, including Google Chrome and Microsoft Edge extensions, which are driving free-to-paid conversion

David Wadhwani, president of the Digital Media Business followed up on the topic of turning free users into paid users and how to increase the usage of Adobe products:

As we've noted in the past, we now have Edge integrations and Chrome integrations. We're also available in Teams. We're also available on mobile devices for iOS and Android. And the mix of all of those continue to grow on a monthly basis. One of the things that we are doing to drive that growth is helping people see the value of sharing a link to the PDF as opposed to sharing the document itself. That in doing so, you get a lot more control in terms of the conversation and feedback and review around that. But it also drives the fact that the recipient is then guaranteed to be viewing the PDF in an Adobe surface that we can then use to close that viral loop and drive further top-of-funnel opportunity to convert.

This was an interesting take from the president of the digital media business, David Wadhwani, on how AI changes the value of all those countless PDFs that are in circulation:

the rise of PDF and PDF becoming the de facto standard for content as unstructured content as a whole is a remarkable foundation for us to be building on. And the distribution we have across desktop, web, mobile, including web extensions is really the foundation of everything we do because that becomes the top of funnel for us. You layer on top of that the fact that generative AI, in general, has come out where unstructured content, especially PDF unstructured content, the 3 trillion PDFs out there that we believe are out there, has suddenly inherently much more value than it did a year ago. And this whole ecosystem is set up well for us.

Adobe Experience Cloud

While most consumers are familiar with Adobe Photoshop and Adobe Acrobat Reader, many are not aware, that they are at least passive users of Adobe’s Experience Cloud. Adobe describes the Experience Cloud as the following

Consumers today buy experiences, not just products, and they demand personalized digital experiences that are relevant, engaging, seamless and secure across an ever-expanding range of channels and surfaces. Businesses increasingly have the same expectations, driving business-to-business (“B2B”) companies to deliver equally engaging and seamless experiences as business-to-consumer (“B2C”) companies.

Adobe Experience Cloud is powering businesses by helping them provide exceptional personalized experiences to their customers via a comprehensive suite of solutions.

The experience cloud consists of three different pillars. Adobe describes these pillars in its annual report in this way:

Content, commerce and workflows. Our products help our customers manage, deliver, personalize, and optimize content delivery; build multi-channel commerce experiences for B2B and B2C customers; strategically plan, manage, collaborate and execute on workflows for marketing campaigns and other projects at speed and scale; and leverage self-serve capabilities to deliver on-brand content.

Data insights and audiences. Our products deliver actionable data to our customers in real time to enable highly tailored and adaptive experiences across platforms.

Customer journeys. Our products help businesses manage, test, target and personalize customer journeys delivered as campaigns across B2B and B2C use cases.

To summarize the Experience Cloud: All these programs are used to create detailed customer profiles and then offer an individualized website/app to reach higher sales conversion rates. On top of that, the marketing and sales team can work together in a workflow-based approach and have a cloud-based store of all the relevant assets.

Digital Experience is used by 85 of the Fortune 100 companies. Anil Chakravarthy the president of Digital Experience Business had an interesting quote in the most recent earnings call. This shows you how much data Adobe is aggregating with its platform.

Digital remains a critical growth imperative for businesses around the world. Adobe Digital Insights, which analyzes trillions of data points, reported that both Black Friday and Cyber Monday sales hit record highs of $10.8 billion and $13.3 billion, jumping 10.2% and 7.3% from last year, respectively.

Adobe extended its lead over the next competitors in the Gartner Magic Quadrant compared to the report of 2023. This is another indicator of how well Adobe is performing in this sector.

Adobe Publishing and Advertising

In this segment Adobe groups some remaining legacy products such as eLearning solutions or web conferencing tools. Since this segment just makes up 1% of Adobe’s revenue, I will not go into more detail here.

Writing a deep dive takes me 40+ hours to get a proper understanding of the company and the attributes of the industry it is working in. You will support me a great deal if you a) subscribe to this substack and b) recommend this blog to your friends and family. To all existing subscribers: Thank you for your support! :)

The Business

Adobe generates almost all of its revenue from subscriptions. This is by design and one of the reasons why I like Adobe a lot. Revenue from subscriptions is a lot more predictable than revenue from one-time sales.

Back in 2008, Adobe started to offer its products on a subscription basis and as a result, the revenue was flat for a couple of years, before the strategy started working. One of the reasons is the fact, that a one-time purchase brings you all the revenue in year 1 but none in the years afterward. By changing to subscription, the company forgoes revenue in the first years but gains a steady income source. For Adobe the turning point was 2015 when the engine really started working and it has been marvelous ever since.

Adobe clusters its business into three segments for reporting: Digital Media (that is Document and Creative), Digital Experience, and Publishing and Advertising (which does almost no revenue). Both Digital Media and Digital Experience have shown strong growth over the last quarters both in relative and absolute terms.

The ARR (annual recurring revenue) looks great as well. This is the expected annual revenue from the existing subscriptions. The ARR is a leading indicator of where the revenue is bound to go. Every quarter posts a new record high. This is the way to go.

One more important metric to consider is the RPO (remaining performance obligations). This is the value of open contracts which have not yet been delivered and therefore not counted as revenue.

All of the above-shown metrics lead in the right direction.

MOAT

I am looking for a business with a strong moat. In the best case, we even have some alligators and crocodiles in our moat.

If you ask anybody serious about photography and editing pictures which software they use, they will answer Photoshop. Ask a random person on the street, which PDF viewer and editor they use, and you will most likely get the answer: Acrobat Reader.

Once you learn how to use Photoshop, you are very unlikely to change to a different software and learn how to handle it from scratch. Since Photoshop is the default for image editing, it is already being taught in universities and the graduates will naturally apply their skills also in their professional lives.

Even regarding the all-present topic of AI, Adobe has something in store for you. Midjourney made text-generated images popular and Adobe Firefly does the same. This will change how computer-based images are created forever. The main benefit of Adobe Firefly will be the safe choice for commercially used generated content since Firefly is trained on licensed content and will be integrated into Adobe’s other software solutions. CEO Shantanu Narayen stated:

from our perspective, there are 3 layers to what we're doing as it relates to AI. We're focused on data. Very, very differentiated in that we are designing all our models to be commercially safe, something that actually is very important to all enterprises. I know a lot of you are also working for large enterprises, and they don't want to use models that are not designed to be commercially safe.

More than 16 billion images and videos have been created with Firefly until now. Check out these two videos to get an idea of how powerful generative AI already is:

Many companies are struggling with the darkening macro outlook and companies are looking for ways on how to cut costs. Adobe is not affected by this change in customer spending. Adobe’s CEO spoke of customers who are increasing their usage of Adobe products to save money.

Adobe Firefly is set to release its video model next year. This means that you can create and edit videos with the help of AI. I am curious to see how good this one will be since video editing is a lot more complex than editing a single, still-standing image.

Management

The CEO Shantanu Narayen has been with Adobe since 1998 and was appointed CEO in 2007. You rarely find a CEO in one of the big tech companies with a longer tenure. He owns $162m worth of Adobe shares and is interested in the great long-term performance of the company and therefore its stock.

In the last 16 quarters, Adobe only missed once the analyst’s forecasts. I personally like companies that are planning conservatively and don’t promise the moon to the investors.

The focus of the management is on cash flow and not on earnings. That shows me, that the management understood what’s important for the long-term well-being of a company.

In stark contrast to Meta or Alphabet, Adobe did not over-hire like crazy in the Covid years and therefore does not fire people compared to the other two companies. This shows a strategic long-term focus without irrationally based acting. Also as an employee, this must be seen as a good sign for their job safety.

Talking about the long-term view: This is what Dan Durn, CFO of Adobe, said in the Q4/2024 earnings call:

Quarterly profile, we view it as less important. Really want to focus on revenue and EPS, focus on the annual book of business growth. We think that's the most important way to look at the business. It's also how we, as the management team, run the business.

Some words on the Figma Takeover

One controversial topic regarding Adobe is the announced 20-dollar-heavy takeover of Figma. While I believe that $20 billion for such a small company is outrageous, I understood the rationale behind the deal. The UX designers I worked with described Figma as a religion, not a product. Especially in UX/UI design for software and apps, Figma was adopted very fast and threatened the almighty Adobe suite.

By buying the largest threat in a while, Adobe wanted to cement its position as the untouchable number 1 in all creative matters. At the end of the day, the takeover will be decided by the regulatory bodies who are currently investigating if this will give Adobe too much market power. We shall see what the regulators will decide on. Adobe decided not to pursue the Figma takeover since the regulatory body in the UK already signaled that it would veto the deal. I wish Adobe’s management would have thought this through since the potential Figma deal included a $1 billion break-up fee. This is close to setting money on fire.

Risks

If you want to read the full article and learn about the management, the composition of the segments, takeovers, risks, fundamental analysis, and a conclusion please subscribe and support my work. To all existing subscribers: Thank you for your support and enjoy the rest of the article!

Keep reading with a 7-day free trial

Subscribe to 41investments’s Substack to keep reading this post and get 7 days of free access to the full post archives.